Unraveling the Mystery of Your Malaysian Tax ID

Imagine this: you're about to file your taxes online in Malaysia, feeling organized and prepared. You navigate to the website, coffee in hand, and then bam—a request for your "Tax Identification Number." A wave of panic washes over you. Where do you find it? Is it the same as your national ID? What happens if you don't have it?

Don't worry, you're not alone. Many Malaysians have found themselves in this exact situation, unsure of the intricacies surrounding their Tax Identification Number. Often referred to as the "nombor pengenalan cukai," this unique number is your key to navigating the Malaysian tax system.

Think of it like your tax fingerprint. It's unique to you, identifying you as a taxpayer in the eyes of the Lembaga Hasil Dalam Negeri (LHDN), Malaysia's Inland Revenue Board. From filing your annual returns to claiming tax refunds, almost every interaction with the LHDN hinges on this crucial piece of information.

But the importance of your "semakan nombor pengenalan cukai," which translates to "checking your tax identification number," goes beyond just knowing the number itself. It's about understanding what it represents: your responsibility as a citizen to contribute to the nation's development through taxes.

This article will be your guide through the world of Malaysian Tax IDs. We'll cover everything from its history and significance to the benefits of proactively verifying and managing it. Whether you're a seasoned taxpayer or just starting out, understanding your "semakan nombor pengenalan cukai" is essential for a smooth and stress-free tax experience in Malaysia.

Advantages and Disadvantages of Checking Your Tax Identification Number

| Advantages | Disadvantages |

|---|---|

| Ensures you have the correct information for tax filing. | May require some time and effort to verify. |

| Helps prevent identity theft and fraud. | |

| Allows you to access online tax services. |

While there are minimal drawbacks to checking your tax ID, the advantages far outweigh any perceived inconvenience.

Frequently Asked Questions About Tax Identification Numbers in Malaysia

1. What is a Tax Identification Number (TIN) in Malaysia?

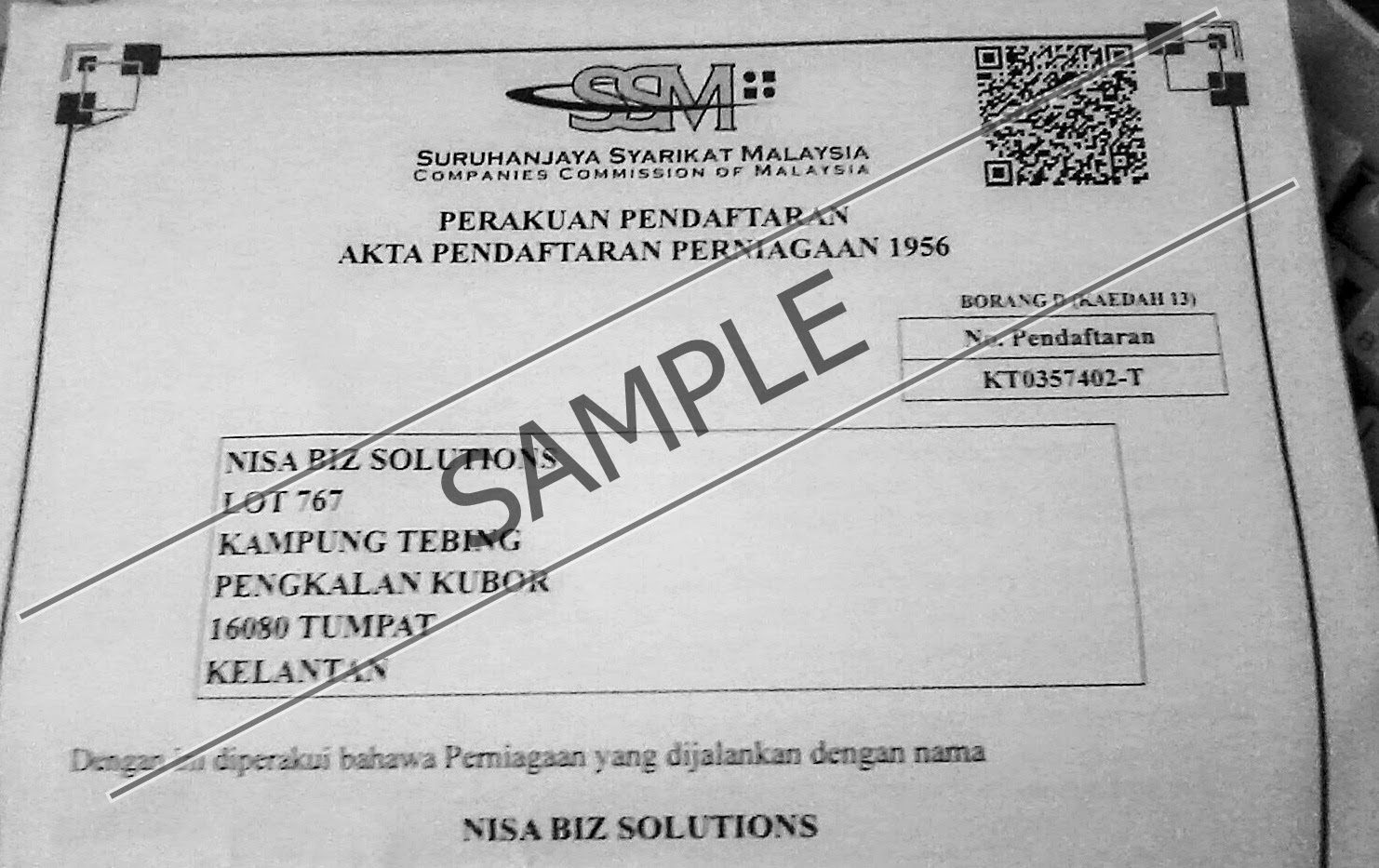

A Tax Identification Number, commonly known as "nombor pengenalan cukai" in Malay, is a unique number assigned to individuals or businesses for tax purposes in Malaysia.

2. Is my Malaysian Tax ID the same as my MyKad number?

Yes, for most individuals, the Malaysian Tax ID is the same as the identification number on your MyKad.

3. How can I verify my Tax Identification Number?

You can verify your TIN through the LHDN's official website, by visiting an LHDN branch, or by contacting their customer service hotline.

4. What do I need to verify my TIN online?

Generally, you'll need your MyKad number, full name, and other personal details to verify your TIN online.

5. What if I've lost my MyKad and need my Tax ID?

Contact the LHDN immediately and they will guide you through the necessary steps to retrieve your Tax ID information.

6. What are the consequences of not having a Tax Identification Number?

Without a valid TIN, you won't be able to file your taxes, claim refunds, or access various tax-related services in Malaysia.

7. Who should I contact if I have more questions about my Malaysian Tax ID?

The LHDN is your primary resource for all tax-related inquiries in Malaysia. You can reach out to them through their website, hotline, or by visiting an LHDN branch.

8. How often do I need to check my Tax Identification Number?

It's a good practice to verify your TIN at least once a year, especially before filing your taxes, to ensure all your information is accurate and up to date.

Understanding and managing your "semakan nombor pengenalan cukai" might seem like a small detail in the grand scheme of things, but it's a fundamental step in fulfilling your tax obligations in Malaysia. By actively engaging with your tax responsibilities, you not only ensure a smoother tax filing experience for yourself but also contribute to the nation's growth and development. Remember, knowledge is power, and when it comes to your taxes, staying informed is always beneficial.

Unlocking victory navigating the labyrinth of fantasy premier league top picks

Revitalize your leather a guide to local leather upholstery repair

Finding comfort and solace exploring the impact of safe and sound