Unlocking Your Options: Understanding Qualifying Life Event Effective Dates

Life is full of unexpected turns, taking us from one milestone to the next. We celebrate new beginnings, navigate unexpected changes, and sometimes face difficult transitions. In the midst of these life events, it's easy to overlook the logistical and administrative details that accompany them. One crucial aspect often missed is understanding "qualifying life event effective dates" and their impact on vital aspects of our lives, like insurance coverage and benefits.

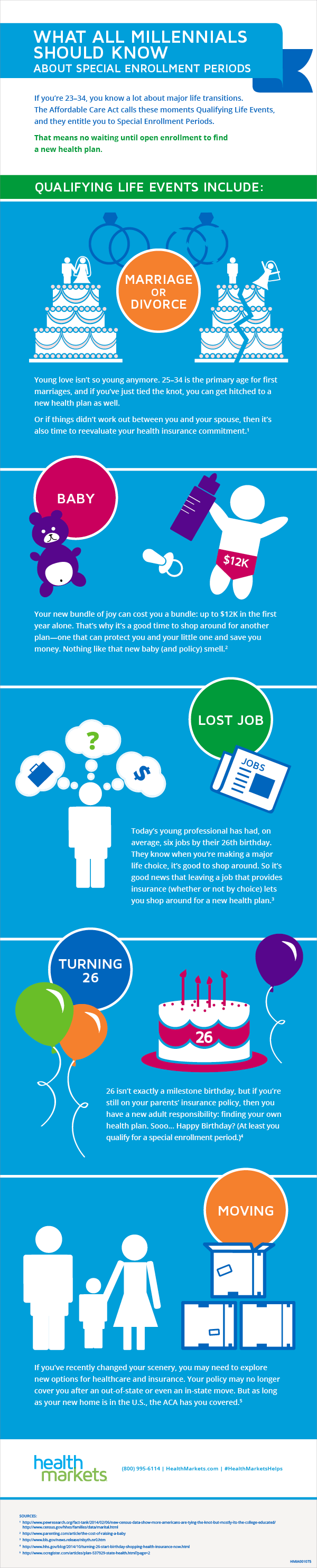

Imagine this: you recently got married, congratulations! You're excited to start this new chapter, but have you considered how this impacts your health insurance? Can you add your spouse to your plan immediately, or is there a specific timeframe? This is where understanding qualifying life events and their effective dates becomes crucial. These dates act as triggers, opening a special enrollment period that allows you to make changes to your insurance plans outside of the typical open enrollment window.

But it's not just about marriage. Qualifying life events encompass a range of situations, from the joyous arrival of a new baby to significant changes in employment status, loss of coverage, or even moving to a new geographic area. Each event carries its own set of regulations and timelines for updating your coverage, and understanding these nuances can save you from unexpected gaps in coverage, potential penalties, or missed opportunities to secure the benefits you need.

Navigating the world of qualifying life events and their effective dates might seem daunting at first. Still, it's empowering to understand how these events influence your options and empower you to make informed decisions about your insurance and benefits during critical junctures in life.

Throughout this article, we'll demystify the concept of qualifying life event effective dates, explore common examples, break down the rules and regulations, and equip you with the knowledge and resources to confidently navigate these important life transitions. Whether you're planning a major life change or simply want to be prepared for whatever life throws your way, understanding this aspect of your benefits can provide invaluable peace of mind.

While this article provides a general overview of qualifying life event effective dates, it's important to remember that specific regulations and guidelines may vary depending on your location, employer, and the type of insurance or benefits you're considering. Always consult with your employer's HR department, your insurance provider, or a qualified benefits advisor for personalized guidance and clarification on your specific situation.

Advantages and Disadvantages of Understanding Qualifying Life Event Effective Dates

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Navigating Qualifying Life Event Effective Dates

- Know your deadlines: Familiarize yourself with the specific timeframes allowed for making changes after a qualifying life event.

- Gather necessary documentation: Be prepared to provide supporting documentation, such as marriage certificates, birth certificates, or termination notices, to verify your qualifying life event.

- Review your options carefully: Take the time to compare plans and coverage options to ensure you're selecting the best fit for your new circumstances.

- Don't hesitate to ask for help: Reach out to your HR department, insurance provider, or a benefits advisor if you have questions or need assistance.

- Stay informed: Life is constantly changing, so it's important to stay informed about updates or changes to qualifying life event guidelines and regulations.

Common Questions and Answers About Qualifying Life Event Effective Dates

1. What are some examples of qualifying life events?

Common examples include marriage, birth or adoption of a child, divorce, loss of other coverage, changes in employment status, and relocation.

2. What is the typical timeframe for making changes after a qualifying event?

You usually have 30 or 60 days from the date of the event, but this can vary depending on the event and your specific plan.

3. Can I make changes to my coverage online?

Many insurance providers allow you to make changes online through their website or mobile app.

4. What happens if I miss the deadline for making changes?

You may have to wait until the next open enrollment period to make changes to your coverage, which could leave you with inadequate coverage in the meantime.

5. Are all life events considered "qualifying" events?

No, not all life events trigger a special enrollment period. For example, simply moving to a new home within the same geographic area might not qualify.

6. Can I make changes to my coverage if I lose my job?

Yes, losing your job is considered a qualifying life event, and you'll have options to explore, such as COBRA continuation coverage or enrolling in a new plan through the Marketplace.

7. What if my employer doesn't offer health insurance?

You can explore individual health insurance plans through the Health Insurance Marketplace or through a licensed insurance broker.

8. Where can I find more information specific to my situation?

The best resources are your employer's HR department, your insurance company's website or customer service line, and Healthcare.gov (for US residents).

Tips for Navigating Qualifying Life Event Effective Dates

- Be proactive and research your options before a life event occurs if possible.

- Keep meticulous records of important dates, communication with providers, and documentation submitted.

- Don't be afraid to ask questions and seek clarification if anything is unclear.

In conclusion, navigating the intricacies of qualifying life event effective dates is essential for anyone seeking to maintain comprehensive and cost-effective insurance coverage during significant life changes. While the rules and regulations surrounding these events might seem complex, understanding the basics empowers you to take control of your coverage and make informed decisions that align with your evolving needs. Remember, you don't have to navigate this process alone. Leverage the resources available to you, seek personalized guidance from qualified professionals, and face life's transitions with confidence knowing you have the right coverage in place every step of the way.

Wells fargo bank class action lawsuits a guide for consumers

Unleash your inner fan the ultimate guide to experiencing wwe raw live

Decoding the automotive air conditioning pump