Unlocking Your Financial Story: Understanding Your Maybank Bank Statement (Penyata Akaun Bank Maybank)

In today's fast-paced world, managing your finances effectively is crucial. Whether you're a seasoned investor or just starting, keeping track of your income and expenses is paramount. Your bank statement, or as it's known in Malay, "Penyata Akaun Bank," serves as a financial roadmap, offering valuable insights into your spending habits, cash flow, and overall financial health.

Imagine this: you're working towards a significant financial goal, like purchasing your dream home or planning a dream vacation. Your bank statement acts as a compass, guiding you toward your destination. By diligently reviewing your Maybank bank statement (Penyata Akaun Bank Maybank), you gain a clear understanding of where your money is going, allowing you to make informed decisions and necessary adjustments to stay on track.

But it's more than just numbers on a page. Your Maybank bank statement tells a story—your financial story. Each transaction, from your daily coffee purchase to your monthly rent payment, paints a picture of your financial habits. By analyzing these patterns, you can identify areas for improvement, such as curbing unnecessary expenses or exploring investment opportunities.

However, navigating the intricacies of a bank statement, especially for first-time users, can seem daunting. Fear not, for this guide will equip you with the knowledge and tools to decode your Maybank bank statement, empowering you to take control of your finances like a pro.

In the following sections, we'll delve into the different components of a Maybank bank statement, explore its significance in personal finance, and uncover practical tips to maximize its potential. By the end, you'll be well-versed in deciphering your financial story and leveraging those insights to achieve your financial aspirations. Let's embark on this journey to financial literacy together!

While the specifics of a Maybank bank statement might slightly differ based on individual account types and preferences, the fundamental elements remain consistent. These include:

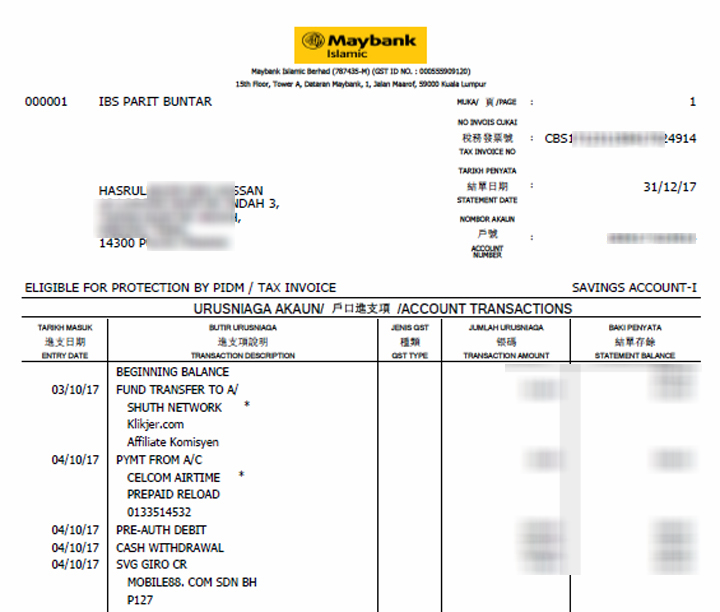

- Account Information: This section displays your personal details, including your full name, account number, and the statement period.

- Opening and Closing Balance: These figures represent the amount of money in your account at the beginning and end of the statement period, respectively.

- Transaction History: This is the heart of your bank statement, listing all your transactions chronologically. Each entry includes the date, description, transaction amount, and balance after each transaction.

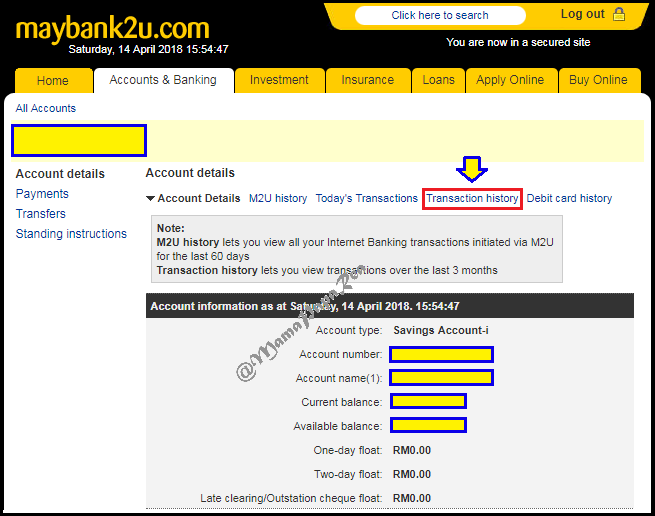

Advantages and Disadvantages of Online Bank Statements

In today's digital age, most banks, including Maybank, offer the convenience of online banking and e-statements. Let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Convenience: Access your statements anytime, anywhere with internet access. | Security Risks: Online platforms might be susceptible to hacking or phishing attempts. |

| Environmentally Friendly: Reduces paper waste and promotes sustainability. | Technology Dependence: Requires a stable internet connection and device compatibility. |

| Easy Tracking and Organization: Download, store, and manage your statements digitally. | Lack of Physical Copy: Some individuals prefer having a physical copy for record-keeping. |

Understanding your Maybank bank statement is fundamental to effective financial management. It's not just a document; it's your financial journey, laid out in black and white. By embracing its insights, you equip yourself with the power to make informed decisions, reach your financial goals, and build a secure financial future.

Computer wont wake with keyboard deep dive into sleepy pcs

Anime black manga hoodies a deep dive into the fandom fashion phenomenon

What is a man bun a deep dive into the hair phenomenon