Unlocking Your Financial Power: Understanding Your Total Compensation

Are you making the most of your hard-earned money? Most people focus solely on their base salary, but that's like seeing only one slice of a delicious pie. To truly understand your financial picture, you need to consider your total compensation – the complete package of financial rewards you receive for your work.

Imagine this: you're comparing two job offers. One boasts a slightly higher base salary, while the other offers a lower base but includes additional benefits and allowances. Which one is truly better? The answer isn't always obvious. That's why understanding your total compensation, including elements like allowances and benefits, is crucial for making informed decisions about your career and your finances.

Think of it like building a house. Your base salary is the foundation, but the allowances and benefits are the walls, roof, and all the things that make it a home. You wouldn't settle for just a foundation, would you? Similarly, don't shortchange yourself by focusing solely on the base salary number.

In today's competitive job market, companies are getting creative with their compensation packages. Understanding the different elements of your total compensation can help you negotiate a better deal, make informed career choices, and ultimately, achieve your financial goals faster. This means taking into account everything from retirement contributions and health insurance to bonuses and professional development opportunities.

It's time to ditch the limited perspective of just the base salary and embrace the bigger picture. Let's explore the world of total compensation, uncover its hidden benefits, and empower you to make the most of your earning potential.

Let's start by understanding the various components that contribute to your total compensation package. These might include:

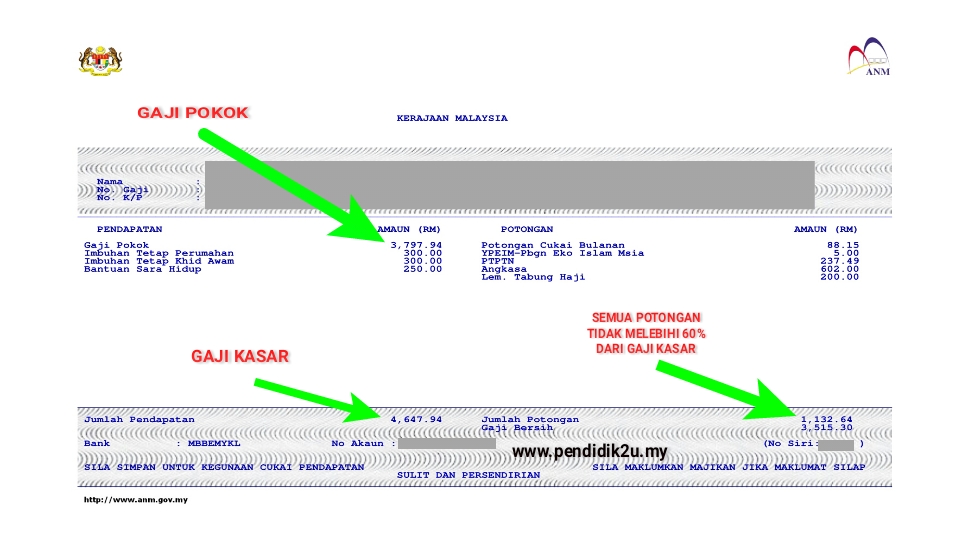

- Base salary: This is the fixed amount you earn regularly, typically paid monthly or bi-weekly.

- Allowances: These are additional payments made to cover specific expenses, such as transportation, housing, or meals.

- Bonuses: These are one-time payments awarded for achieving specific targets or exceeding expectations.

- Retirement contributions: Many employers offer plans where they contribute a percentage of your salary to a retirement account, helping you secure your financial future.

- Health and other insurance: Valuable benefits like health, dental, and life insurance can save you significant money on healthcare and provide peace of mind.

- Paid time off: Don't underestimate the value of paid vacation time, sick leave, and holidays, which contribute to your work-life balance and overall well-being.

- Professional development: Companies may offer opportunities for training, conferences, or further education, enhancing your skills and boosting your career growth.

By considering the combined value of all these components, you can accurately assess the true worth of a job offer or your current compensation package. Remember, a higher base salary doesn't always translate to a better overall deal. A company offering a comprehensive benefits package might actually be more financially rewarding in the long run.

Now that you understand the importance of considering total compensation, let's explore some practical tips to help you maximize your earnings and achieve financial freedom faster.

- Research and compare: Before negotiating a salary or considering a job offer, research industry benchmarks and compare compensation packages for similar roles.

- Negotiate like a pro: Don't be afraid to negotiate your salary and benefits package. Highlight your skills, experience, and the value you bring to the table.

- Maximize your benefits: Take full advantage of all the benefits offered by your employer. Contribute enough to your retirement plan to receive the full employer match, and utilize your health insurance and other perks wisely.

- Continuously improve your skills: Invest in yourself by pursuing professional development opportunities. By enhancing your skills and knowledge, you increase your value to employers and open doors for career advancement and higher earning potential.

- Track your progress and adjust: Regularly review your compensation and benefits package to ensure it aligns with your current needs and financial goals. Don't hesitate to negotiate a raise or explore new opportunities if you feel undervalued.

Remember, your financial well-being is in your hands. By adopting a holistic view of your total compensation and making informed decisions, you can unlock your full earning potential and pave your path to financial freedom.

The unsung symphony of towables exploring the world of water tubes for boating

Rev up your creativity unleashing the power of monster truck clip art

Discover the charm of riley farms in fort smith arkansas