Unlocking Your Financial Future: Cara Dapatkan Nombor Cukai Pendapatan

In the intricate dance between citizens and government, taxes often take center stage. For many Malaysians, the journey begins with understanding "cara dapatkan nombor cukai pendapatan," or how to obtain an income tax number. This crucial identifier serves as your financial fingerprint in the eyes of the Lembaga Hasil Dalam Negeri (LHDN), Malaysia's Inland Revenue Board. But why is this number so important, and how does one go about acquiring it?

Imagine a system where financial transactions exist in a nebulous realm, devoid of clear identification or accountability. This is where the income tax number steps in, bringing order to the financial ecosystem. It's your unique identifier, enabling the government to track income, deductions, and ultimately, ensure everyone contributes their fair share to the nation's development.

The significance of obtaining your income tax number cannot be overstated. It's not merely a bureaucratic formality; it's your passport to financial transparency and participation. Without it, you're effectively invisible within the formal economy, unable to enjoy benefits and privileges afforded to tax-paying citizens.

The concept of income tax, and by extension, the income tax number, is not unique to Malaysia. Globally, governments rely on taxation systems to fund public services, infrastructure projects, and social welfare programs. The method of obtaining this crucial number might differ from country to country, but the underlying principle remains the same – to establish a clear and accountable financial framework.

In Malaysia, the process of obtaining an income tax number is relatively straightforward, yet many individuals find themselves unsure of the steps involved. This lack of clarity can lead to confusion, procrastination, and in some cases, even unintentional non-compliance. Therefore, understanding the 'cara dapatkan nombor cukai pendapatan' is not just about fulfilling a legal obligation; it's about empowering individuals to navigate the financial landscape with confidence and ease.

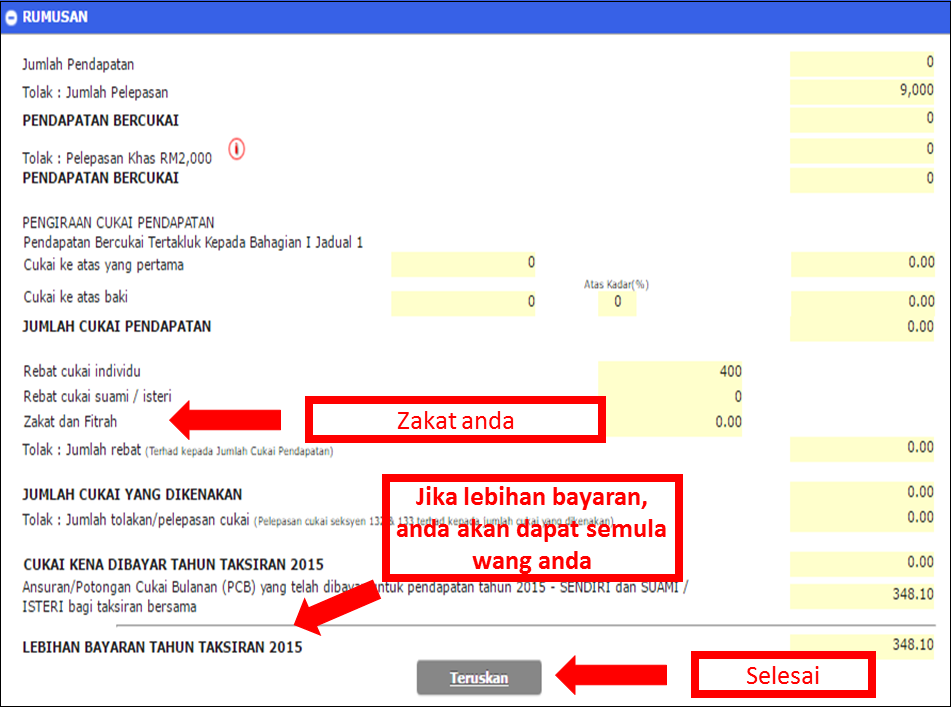

Advantages and Disadvantages of Obtaining an Income Tax Number

While obtaining an income tax number is generally seen as advantageous, it's worth considering both sides of the coin:

| Advantages | Disadvantages |

|---|---|

| Essential for legal employment and financial transactions | Potential for identity theft if personal information is not handled securely |

| Enables access to government benefits and subsidies | Obligation to file annual tax returns, even with minimal or no income |

| Facilitates loan applications and financial credibility | Possible audits or investigations by tax authorities |

Navigating the world of taxes can seem daunting, but understanding the fundamentals, such as 'cara dapatkan nombor cukai pendapatan,' empowers you to take control of your financial well-being. By obtaining your income tax number and fulfilling your tax obligations, you contribute to both your personal financial health and the nation's collective prosperity.

Ink island finding the best tatuadores en puerto rico

Unlocking language what is another word for entry

Unlocking literacy your guide to k5 learning grade 2 english