Unlocking Opportunities: Navigating the Qualifying Life Event Time Frame

Life is a whirlwind of changes, throwing curveballs our way when we least expect them. New jobs, marriage, the birth of a child, even losing health coverage – these major life events often necessitate swift adjustments to our financial and insurance plans. But what many people don't realize is that these life transitions often come with a hidden advantage: the qualifying life event time frame.

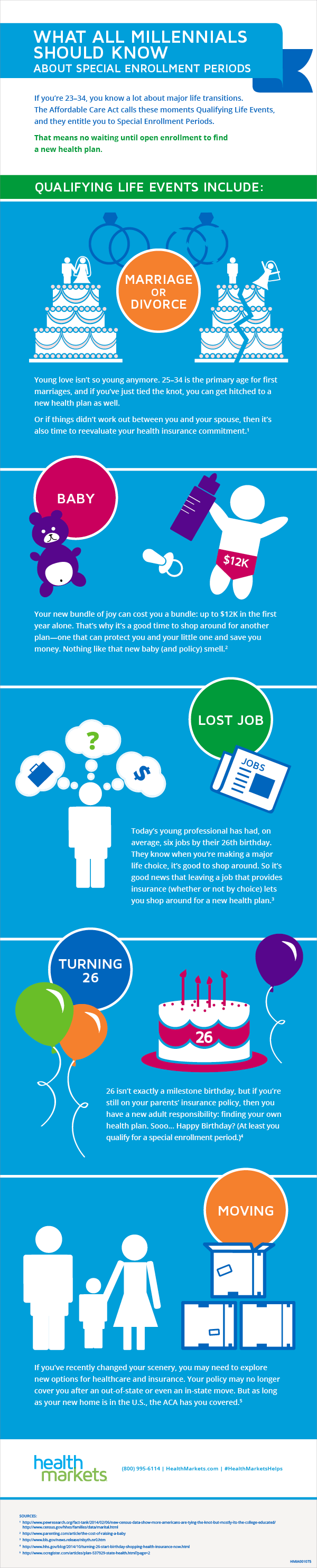

This period, also sometimes referred to as a special enrollment period, acts like a safety net, allowing you to make changes to your benefits outside the usual open enrollment windows. Failing to understand how it works, however, can mean missing out on crucial opportunities to secure the coverage you and your loved ones need.

Navigating these periods effectively requires understanding their nuances, deadlines, and potential pitfalls. In this comprehensive guide, we'll delve deep into the world of qualifying life events and how they can empower you to make informed decisions about your future.

Imagine this: you've just started a new job and are overwhelmed with paperwork. Buried deep within the stack of forms is information about your health insurance options. You might be tempted to just check the boxes and move on, but this is where understanding qualifying life events comes in. Starting a new job is a prime example of a QLE that opens a window to reassess and potentially change your health plan, even if it's outside the typical open enrollment timeframe.

This concept isn't new. It's been woven into the fabric of employee benefits and insurance for decades, evolving alongside the changing landscape of healthcare and employment. The core principle remains the same: to provide individuals and families with the flexibility to adapt their coverage during times of significant transition. But with evolving regulations and diverse life circumstances, understanding the specifics of qualifying life events has become more crucial than ever.

Advantages and Disadvantages of Qualifying Life Event Time Frame

| Advantages | Disadvantages |

|---|---|

| Flexibility to adjust coverage outside open enrollment | Time-sensitive nature can create pressure and urgency |

| Opportunity to secure coverage after a life-changing event | Potential for confusion and misunderstanding of eligibility criteria |

| Ensures access to essential benefits during vulnerable periods | May require documentation and proof of qualifying event |

Best Practices for Navigating the Qualifying Life Event Time Frame

1. Be Proactive, Not Reactive: Don't wait for a life event to sneak up on you. Familiarize yourself with common QLEs and their implications beforehand.

2. Mark Your Calendar: Once a qualifying event occurs, note the deadline for making changes to your benefits. These timeframes are often strict, so don't let procrastination lead to missed opportunities.

3. Gather Your Documentation: Be prepared to provide proof of your qualifying event, such as marriage certificates, birth certificates, or termination notices.

4. Explore All Options: Don't rush into a decision. Take the time to thoroughly research and compare different health plans, coverage options, and costs to make the best choice for your situation.

5. Seek Expert Guidance: If you're unsure about your eligibility or need help navigating the process, reach out to your employer's HR department or an insurance broker for assistance.

Common Questions and Answers about Qualifying Life Events

1. What is a Qualifying Life Event?

A qualifying life event is a significant change in your life that makes you eligible to enroll in or change your health insurance coverage outside of the usual open enrollment period.

2. What are some common examples of Qualifying Life Events?

Common QLEs include: marriage, divorce, birth or adoption of a child, losing other health coverage, moving to a new state, changes in your income, and certain changes in your dependent's status.

3. How long do I have to make changes to my coverage after a Qualifying Life Event?

Generally, you have 60 days from the date of the qualifying event to enroll in or change your coverage. However, specific deadlines may vary depending on the event and your insurance provider.

4. Do all health insurance plans recognize the same Qualifying Life Events?

Most plans adhere to a standard set of qualifying events, but it's always a good idea to check with your specific plan to confirm eligibility.

5. Can I change my coverage for myself and my dependents during a Qualifying Life Event?

Yes, QLEs typically allow you to make changes for yourself and your eligible dependents.

6. What happens if I miss the Qualifying Life Event deadline?

Missing the deadline could mean you're unable to make changes to your coverage until the next open enrollment period.

7. Where can I find more information about Qualifying Life Events?

Resources include Healthcare.gov, your employer's HR department, and reputable insurance brokers.

8. What if my Qualifying Life Event is denied?

You may have the option to appeal the decision. Contact your insurance provider for information about the appeals process.

Tips and Tricks

* Keep Records Organized: Maintain a file for all important documents related to your QLEs to streamline the process.

* Set Reminders: Utilize calendar alerts or phone reminders to ensure you don't miss crucial deadlines.

* Don't be afraid to ask questions: Reach out to your insurance provider or HR representative if you need clarification on any aspect of the QLE process.

The qualifying life event time frame is a powerful tool for navigating life's twists and turns with greater financial security and peace of mind. By understanding the ins and outs of these periods, individuals and families can proactively adapt their coverage, ensuring access to vital benefits when they need them most. Remember, knowledge is power – empower yourself by staying informed and prepared to make the most of your qualifying life events.

Understanding the va disability tbi rating schedule

Cool drum gifs for wallpapers rock the perfect beat for your screen

The soul of an icon who plays apollo creed