Unlocking Homeownership: Your Guide to Pekeliling Pinjaman Perumahan Kerajaan

Ever dreamed of ditching your landlord and finally owning your own place? That feeling of planting roots, building equity, and painting your living room any color you darn well please? It's a common goal, and for many Malaysians, the "Pekeliling Pinjaman Perumahan Kerajaan" plays a crucial role in making that dream a reality.

Now, before your eyes glaze over at the mention of government circulars, stick with me! This isn't about dry legal jargon. It's about understanding a powerful tool that can unlock affordable homeownership for you. We're going to break down this circular, ditch the confusing terms, and empower you to make smart decisions on your homeownership journey.

Think of "Pekeliling Pinjaman Perumahan Kerajaan" as a set of guidelines, a roadmap of sorts, designed to regulate housing loans offered to Malaysian civil servants. These guidelines touch upon everything from loan eligibility and interest rates to repayment terms and other crucial factors.

Why should you care? Well, because understanding these rules can be the difference between struggling with a hefty mortgage and comfortably affording your dream home. It's about leveraging the system to your advantage, getting the best possible loan terms, and ultimately keeping more of your hard-earned Ringgit in your pocket.

So, whether you're a first-time buyer overwhelmed by the process or a seasoned homeowner looking to refinance, this guide will equip you with the knowledge you need to navigate the Malaysian housing market with confidence. Let's dive in and unlock the secrets of the "Pekeliling Pinjaman Perumahan Kerajaan."

Advantages and Disadvantages of Pekeliling Pinjaman Perumahan Kerajaan

While "Pekeliling Pinjaman Perumahan Kerajaan" offers significant benefits, it's essential to weigh both the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Lower interest rates compared to commercial loans. | Eligibility restricted to Malaysian civil servants. |

| Flexible repayment terms, often extending to retirement age. | May involve a longer application and approval process. |

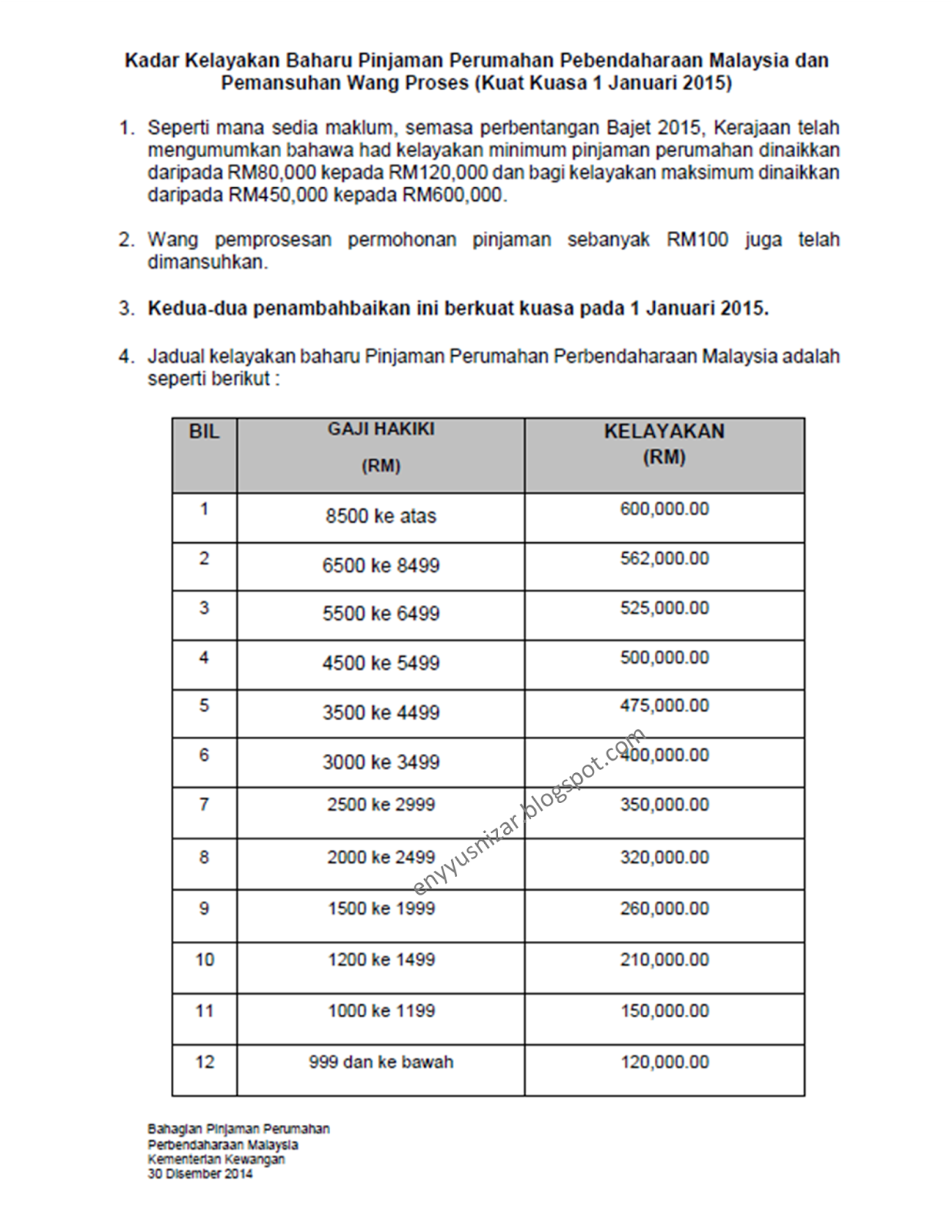

| Potential for government subsidies and financial assistance. | Loan amount may be limited based on salary and service years. |

Best Practices for Navigating "Pekeliling Pinjaman Perumahan Kerajaan"

Here are some practical tips to make the most of these housing loan provisions:

- Do Your Homework: Thoroughly research the guidelines, eligibility criteria, and current interest rates before applying.

- Plan Your Finances: Determine your borrowing capacity, factor in additional costs (legal fees, insurance), and establish a realistic budget.

- Shop Around for the Best Deal: Compare offers from different financial institutions approved under the scheme to secure the most favorable terms.

- Seek Expert Advice: Consult with a financial advisor knowledgeable about government housing loans for personalized guidance.

- Stay Informed: Keep abreast of any updates or revisions to the "Pekeliling Pinjaman Perumahan Kerajaan" to make informed decisions.

Navigating the world of housing loans can feel overwhelming, but understanding the "Pekeliling Pinjaman Perumahan Kerajaan" doesn't have to be. By arming yourself with the right knowledge, planning diligently, and seeking expert advice when needed, you can unlock the door to affordable homeownership and turn your dream of owning a piece of Malaysia into a rewarding reality.

Smooth sailing your guide to community first credit union boat loans

Decoding sherwin williams paint colors your guide

In bloom the rise of floral tattoos on men