Unlocking Growth: Your Guide to Business Financial Planning

Imagine this: you're launching a new product, confident it'll be a hit. But without a clear picture of your financials, how can you be sure you're investing wisely? That's where the power of a well-structured financial plan comes into play. This isn't just about crunching numbers; it's about setting your business on a path towards sustainable growth and profitability.

Think of your business financial plan as a roadmap. It outlines your financial goals and provides a detailed strategy for achieving them. This includes understanding your current financial position, forecasting future performance, and identifying potential roadblocks along the way. Whether you're a seasoned entrepreneur or just starting out, a robust financial plan is your secret weapon to navigate the complexities of the business world.

Throughout history, businesses both large and small have relied on some form of financial planning to make informed decisions. From basic budgeting techniques to sophisticated forecasting models, the core principles remain the same: to gain a clear understanding of income, expenses, and how to optimize resources for maximum impact. While the tools and methods have evolved over time, the importance of financial planning remains paramount in today's dynamic market.

However, creating a comprehensive financial plan can seem daunting, especially for new business owners. Many struggle with accurately forecasting revenue, managing cash flow effectively, and securing the necessary funding to fuel growth. It's easy to get caught up in the day-to-day operations and neglect this crucial aspect of running a business. But remember, a solid financial plan is an investment in your business's future, enabling you to make proactive decisions and avoid potential pitfalls.

In the following sections, we'll demystify the process of building a robust financial plan, breaking down complex concepts into manageable steps. We'll equip you with the knowledge and resources to take control of your business finances and steer your company towards lasting success.

Advantages and Disadvantages of Implementing a Strong Financial Plan

| Advantages | Disadvantages |

|---|---|

| Provides a clear roadmap for achieving financial goals. | Requires time and effort to create and maintain. |

| Helps secure funding from investors and lenders. | May require disclosing sensitive financial information. |

| Enables informed decision-making and reduces financial risks. | Can be inflexible if not updated regularly to reflect changing market conditions. |

| Improves cash flow management and profitability. | May require seeking external expertise, which can be costly. |

5 Best Practices for Effective Financial Planning

1. Set Realistic and Specific Goals: Clearly define your short-term and long-term financial objectives. Instead of aiming for vague targets like "increased profits," specify measurable goals such as "increase net profit margin by 5% in the next fiscal year."

2. Conduct Thorough Market Research: Understand your industry, competitors, and target market to create accurate financial projections. Analyze market trends, pricing strategies, and customer behavior to make informed decisions about pricing, production, and marketing.

3. Monitor and Track Key Performance Indicators (KPIs): Regularly track financial metrics like revenue growth, gross profit margin, and customer acquisition cost to assess the health of your business. Use accounting software or spreadsheets to streamline this process and identify areas for improvement.

4. Seek Expert Advice: Don't hesitate to consult with financial advisors, accountants, or mentors who can provide valuable insights and guidance. They can help you navigate complex financial matters, identify potential risks, and make informed decisions.

5. Regularly Review and Update Your Plan: Your financial plan should be a living document that evolves alongside your business. Conduct regular reviews, at least quarterly or annually, to adjust projections, incorporate new opportunities, and address any challenges.

Frequently Asked Questions About Financial Planning

1. What are the essential components of a business financial plan?

A comprehensive plan typically includes an executive summary, business description, market analysis, competitive analysis, management and organization plan, products and services description, marketing and sales strategy, financial projections, and funding request (if applicable).

2. How often should I update my financial plan?

Review and update your plan at least quarterly or annually, or whenever there are significant changes in your business environment, such as new product launches, market shifts, or changes in regulations.

3. What tools can help me create a financial plan?

You can use spreadsheet software like Microsoft Excel or Google Sheets, accounting software such as QuickBooks or Xero, or specialized financial planning software.

4. How can I improve my cash flow management?

Implement strategies such as invoicing promptly, offering early payment discounts, negotiating favorable payment terms with suppliers, and closely monitoring your accounts receivable and payable.

5. Where can I find funding for my business?

Explore options like bootstrapping, seeking investments from angel investors or venture capitalists, applying for business loans from banks or credit unions, or crowdfunding.

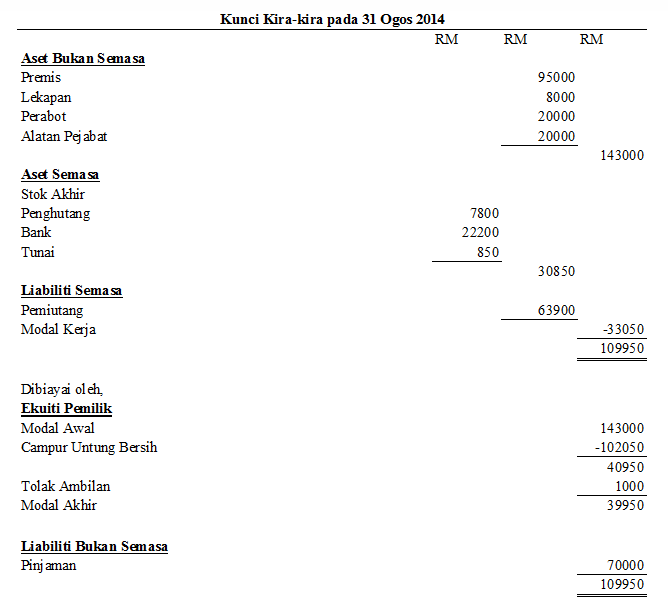

6. What is the difference between a profit and loss statement and a balance sheet?

A profit and loss (P&L) statement shows your business's revenues, expenses, and net income or loss over a period of time. A balance sheet provides a snapshot of your business's assets, liabilities, and equity at a specific point in time.

7. What is financial forecasting, and why is it important?

Financial forecasting involves projecting future financial performance based on historical data, market trends, and business assumptions. It helps you anticipate future financial needs, make informed decisions about investments, and secure funding.

8. What are some common mistakes to avoid in financial planning?

Avoid unrealistic projections, neglecting to track key metrics, failing to adapt to changing market conditions, relying solely on intuition, and neglecting to seek expert advice.

Conclusion: Your Roadmap to Financial Success

In the ever-evolving landscape of business, one thing remains constant: the need for a well-defined financial plan. It's not simply about crunching numbers; it's about painting a clear vision for your business's future and outlining a strategic path to achieve your goals. From securing funding to making informed decisions that drive profitability, a robust financial plan is the bedrock of sustainable growth.

While the process may seem daunting, remember that even small steps towards better financial planning can yield significant benefits. Start by setting clear goals, analyzing your current financial position, and forecasting future performance. Embrace the power of data analysis, utilize available tools and resources, and don't hesitate to seek expert advice when needed.

In a world of uncertainties, your financial plan serves as a guiding light, illuminating the path to lasting success. As you navigate the complexities of the market, a solid financial foundation empowers you to make proactive decisions, mitigate risks, and ultimately achieve your entrepreneurial aspirations. Embrace the power of financial planning and unlock the full potential of your business.

Maximize your kia souls lifespan with proper maintenance

Behr yellow paint colors sunshine in a can

Scrub cap revolution level up your medical style