Unlocking Financial Wellness: Your Guide to State Employee Credit Unions

Are you a state employee seeking financial stability and growth? Navigating the world of personal finance can be challenging, but membership in a credit union designed for state employees can offer valuable resources and support. These institutions often provide tailored services to meet the unique needs of public servants.

State employee credit unions are financial cooperatives owned and operated by their members, who are typically employees of a specific state government. These not-for-profit organizations focus on serving their members rather than maximizing profits, which often translates to better interest rates on loans, higher dividends on savings, and lower fees compared to traditional banks. They offer a wide range of financial products and services, including checking and savings accounts, auto loans, mortgages, and retirement planning tools.

The history of credit unions for state employees is rooted in the principles of cooperative finance. These institutions emerged from the need to provide affordable and accessible financial services to public servants. Over time, they have evolved into sophisticated financial institutions offering comprehensive solutions for their members' financial needs. The core mission remains centered on member well-being and financial empowerment.

The importance of a state employees credit union lies in its ability to provide personalized financial guidance and support. They understand the specific financial challenges faced by state employees and offer tailored solutions to address them. Whether you're saving for a down payment on a house, planning for retirement, or navigating unexpected expenses, a state employee credit union can be a valuable partner in your financial journey.

One of the main issues related to credit unions, including those serving state employees, is the limited field of membership. Eligibility is typically restricted to state government employees and their families. This exclusivity can be a drawback for individuals outside the eligible group seeking the benefits of a credit union.

A state employees' credit union operates under the principle of democratic member control. Each member has an equal vote in electing the board of directors, regardless of their account balance. This ensures that the credit union remains focused on serving the best interests of its members.

Benefit 1: Competitive Interest Rates: Credit unions typically offer higher interest rates on savings accounts and lower interest rates on loans compared to traditional banks. Example: A state employee credit union might offer a higher annual percentage yield (APY) on a certificate of deposit (CD) than a large national bank.

Benefit 2: Lower Fees: Credit unions often have lower or no fees for services such as checking accounts, ATM withdrawals, and overdraft protection. Example: You might avoid monthly maintenance fees on your checking account by joining a state employee credit union.

Benefit 3: Personalized Service: Credit unions prioritize member service and provide personalized financial guidance. Example: A credit union representative can help you create a budget, consolidate debt, or plan for retirement.

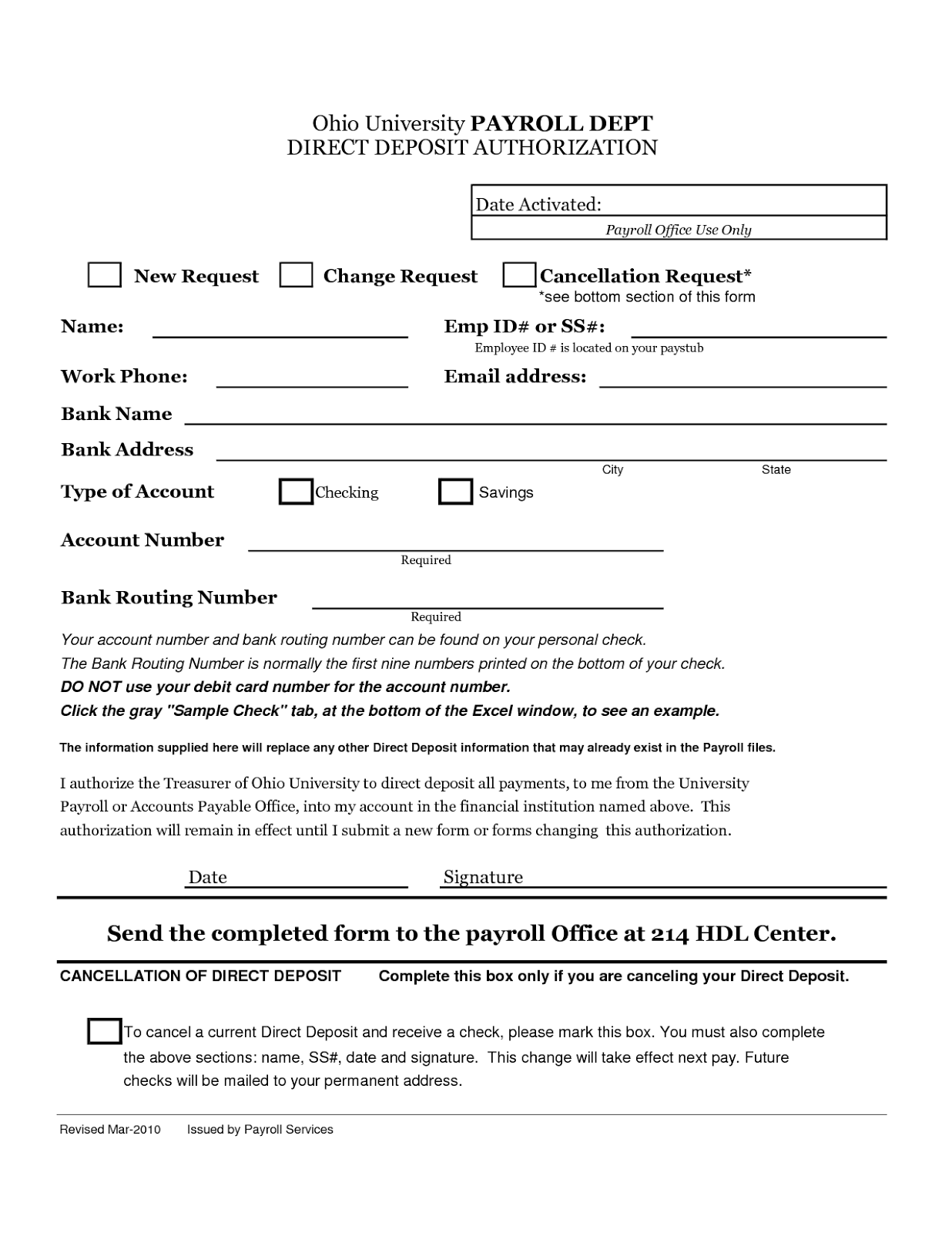

Action Plan: 1. Research credit unions available to state employees in your area. 2. Compare interest rates, fees, and services. 3. Gather necessary documentation for membership application. 4. Open an account and begin taking advantage of the benefits.

Advantages and Disadvantages of State Employee Credit Unions

| Advantages | Disadvantages |

|---|---|

| Lower fees | Limited membership |

| Better interest rates | Fewer branches than large banks |

| Personalized service | May offer fewer online services |

FAQ:

1. Who can join a state employee credit union? Generally, state government employees and their immediate families are eligible.

2. How do I find a state employee credit union in my area? Online searches and inquiries with your state's human resources department can help.

3. Are my deposits insured at a credit union? Yes, deposits are typically insured by the National Credit Union Administration (NCUA), similar to FDIC insurance for banks.

4. What types of accounts and services are offered? Checking, savings, loans, mortgages, and investment services are common offerings.

5. How do I become a member? You'll need to complete a membership application and provide required documentation.

6. Can I access my accounts online? Most credit unions offer online banking services.

7. Are there ATMs available? Yes, credit unions typically participate in ATM networks.

8. How can I contact customer service? Contact information is usually available on the credit union's website.

Tips and Tricks: Take advantage of financial education resources offered by your state employee credit union. Attend workshops, webinars, or consult with financial advisors to improve your financial literacy and make informed decisions.

In conclusion, state employee credit unions offer a unique blend of personalized service, competitive rates, and a focus on member well-being. They represent a valuable financial resource for state employees seeking to enhance their financial health. By understanding the benefits and services offered, state employees can make informed decisions about their finances and work towards achieving their financial goals. Taking advantage of the resources available through these institutions can empower you to build a more secure financial future. Consider exploring the possibilities offered by a state employee credit union and discover how they can help you unlock your financial potential. Take the first step towards a brighter financial future by researching credit unions available to you and discovering the benefits they can provide. Your financial well-being is worth the effort.

Conquering the ucf spring semester finals freedom and future plans

Navigating medicare understanding humana gold ppo options

Sherwin williams sensible gray the ultimate neutral