Unlocking Financial Growth: Mastering Annual Interest Calculation

Ever wondered how your savings grow or how much that loan truly costs? Understanding annual interest calculation is the key to unlocking these financial mysteries. It's a fundamental skill that empowers you to make informed decisions, whether you're saving for a down payment, investing for retirement, or managing debt.

Calculating yearly interest isn't just for financial gurus; it's a practical tool for everyone. From determining the return on your investments to understanding the true cost of borrowing, grasping this concept can significantly impact your financial well-being. Let's dive into the world of interest calculation and discover how it can work for you.

The concept of annual interest has ancient roots, tracing back to early civilizations where lending and borrowing were commonplace. Over time, the methods for calculating annual interest evolved, leading to the formulas and practices we use today. Understanding this history provides context for the importance of accurate interest calculation in modern finance.

One of the main issues surrounding yearly interest rate calculation is the potential for misunderstanding. Different interest types, such as simple and compound interest, can lead to confusion if not properly explained. Furthermore, hidden fees and compounding frequencies can complicate the process, making transparency crucial. Therefore, mastering the basics is essential for navigating the complexities of interest.

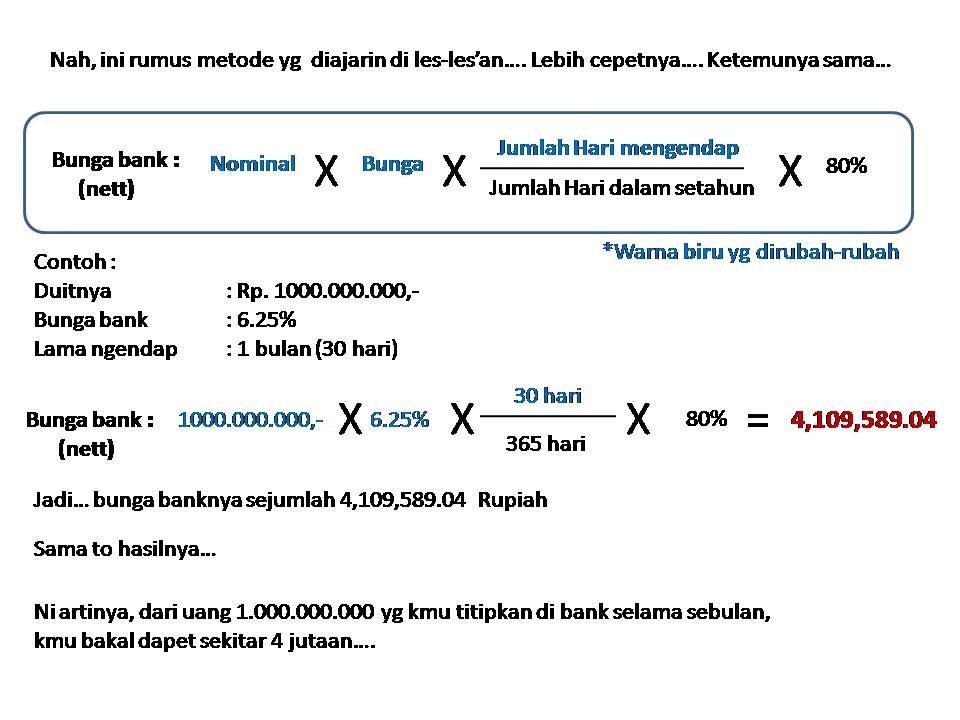

In its simplest form, annual interest is the amount earned or charged on a principal sum over one year, expressed as a percentage. Simple interest is calculated solely on the principal, while compound interest is calculated on the principal plus any accumulated interest. For example, if you invest $1,000 at a 5% simple annual interest rate, you'll earn $50 in interest after one year. With compound interest, you earn interest on the initial $1,000 and the $50 interest, leading to greater returns over time.

Calculating the yearly return on your investment offers numerous benefits. First, it helps you set realistic financial goals. By knowing how much your money can potentially grow, you can plan for major life events like buying a house or retiring comfortably. Second, it enables you to compare different investment options and choose the ones that align with your risk tolerance and financial objectives. Lastly, understanding interest calculations empowers you to manage your debt effectively by evaluating loan terms and minimizing interest payments.

To determine your annual interest earnings, you need the principal amount, the interest rate, and the compounding period. Online calculators and spreadsheets can simplify this process, providing quick and accurate results. Ensure you understand the difference between simple and compound interest and choose the appropriate calculation method for your specific situation.

Before making any financial decisions, consider creating a checklist. Verify the interest rate, compounding frequency, any associated fees, and the calculation method used. This will help you avoid surprises and make informed choices.

Advantages and Disadvantages of Different Interest Calculation Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Simple Interest | Easy to calculate and understand. | Lower returns compared to compound interest over long periods. |

| Compound Interest | Higher returns over time due to the "interest-on-interest" effect. | Can be more complex to calculate manually. |

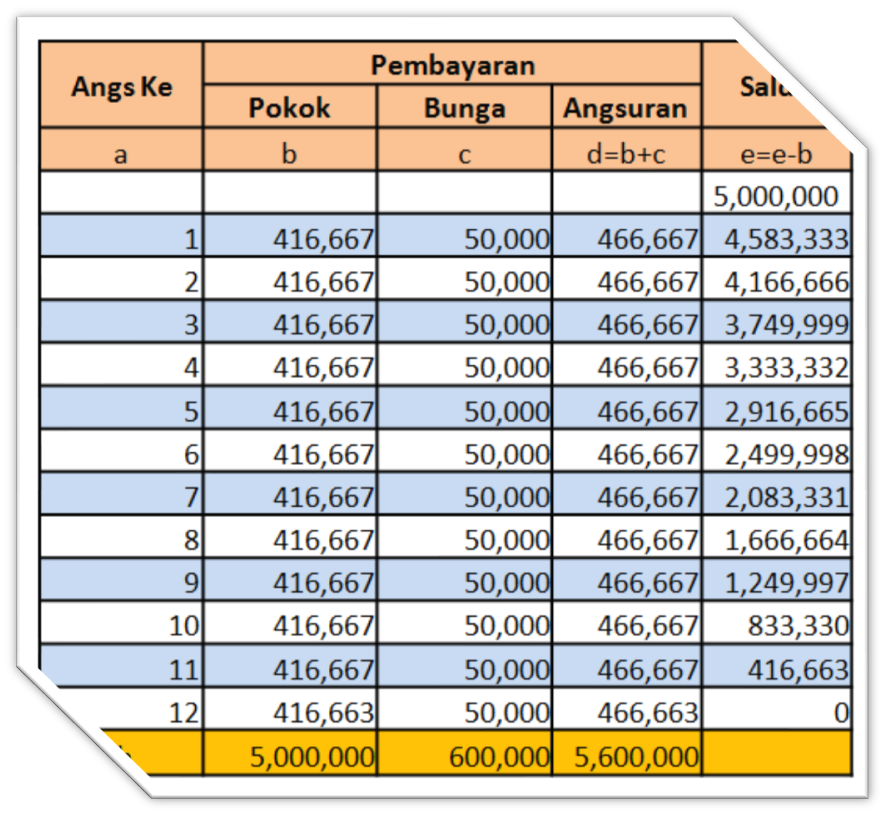

One real-world example is a savings account with a 2% annual interest rate compounded monthly. If you deposit $5,000, your balance after one year will be slightly more than with simple interest due to monthly compounding.

A common challenge is understanding the impact of fees. Some financial products have hidden fees that can eat into your returns. The solution is to carefully review all terms and conditions and factor these fees into your calculations.

FAQ: What is simple interest? How is compound interest calculated? What is APR? What is APY? How do I calculate interest earned on a CD? What is the difference between nominal and effective interest rates? How do I compare loan offers with different interest rates? What is amortization?

A useful tip is to use online interest calculators to quickly compare different investment scenarios and loan options. These tools can save you time and help you make informed decisions.

In conclusion, understanding how to calculate annual interest is a crucial life skill. It empowers you to make sound financial decisions, maximize your investment returns, and manage your debt effectively. From the historical context of interest to the modern complexities of compound interest and varying calculation methods, grasping this concept offers numerous benefits. By actively engaging with interest calculations, utilizing available tools and resources, and seeking clarification when needed, you can take control of your financial future and achieve your financial goals. Start applying these principles today, and you'll be well on your way to building a secure and prosperous financial life. Don't underestimate the power of knowing your numbers; it's the foundation of smart financial planning.

Cfc full form unveiling the impact of these chemical compounds

The art of the welcome creative ideas for carteles de bienvenida

Navigating financial waters understanding socsos death benefit eligibility