Unlocking Financial Fluidity: Unraveling the Mystery of "Un Modelo de la Letra de Cambio"

In today's interconnected world, where financial transactions transcend borders and currencies, ensuring smooth and secure payment processes is paramount. But what if there was a centuries-old instrument that could simplify these transactions, bridging the gap between trust and commerce? Enter "un modelo de la letra de cambio," a Spanish term that translates to "a model of a bill of exchange" in English.

Imagine a world where businesses, both large and small, could navigate the complexities of international trade with ease and confidence. Picture a system where payment obligations are clearly defined, providing a sense of security and predictability for all parties involved. This is the world that "un modelo de la letra de cambio" seeks to create—a world where financial transactions are as fluid and effortless as the flow of goods and services themselves.

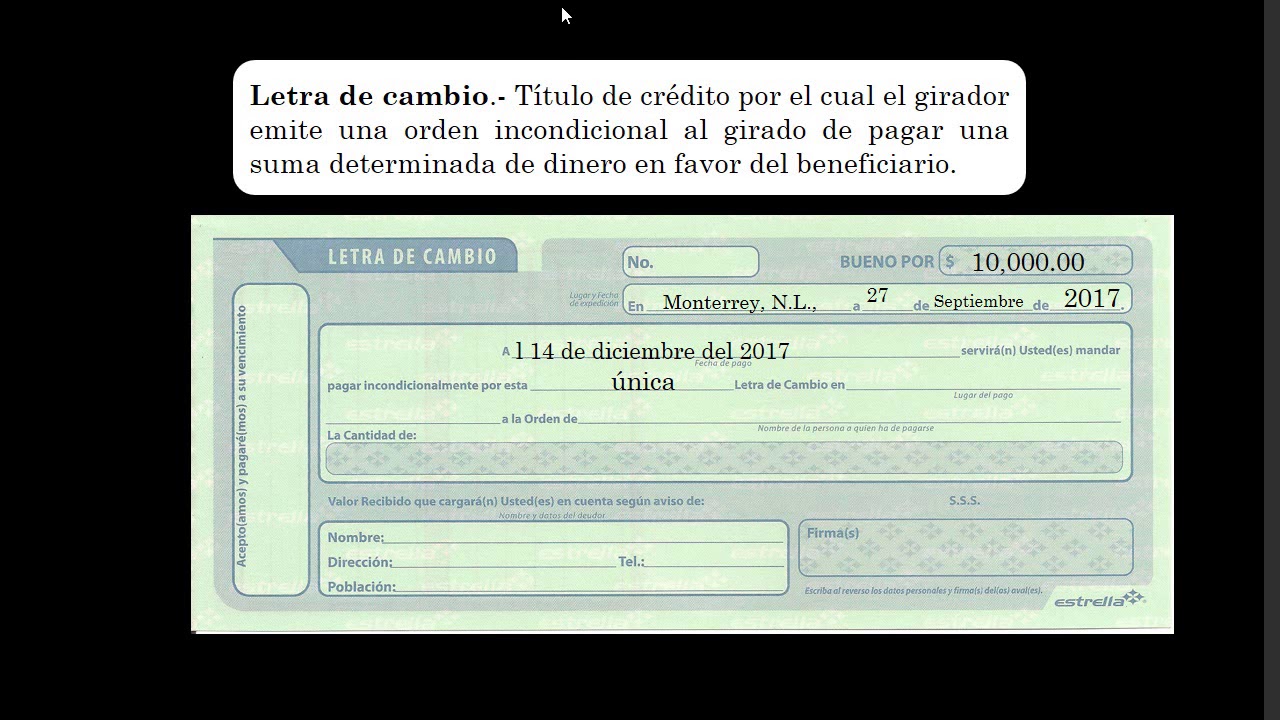

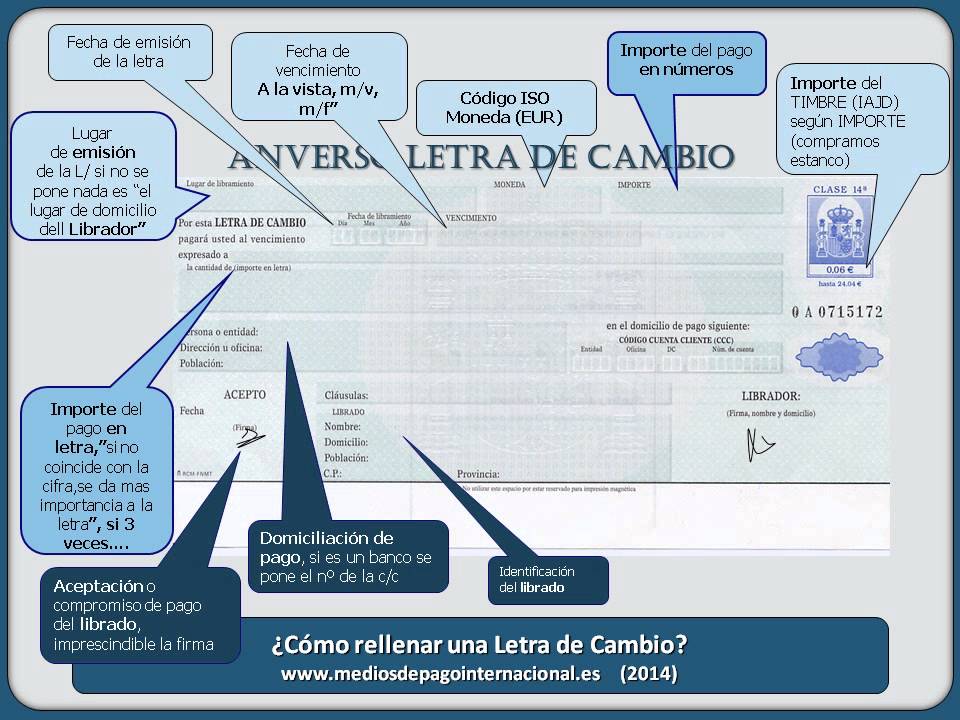

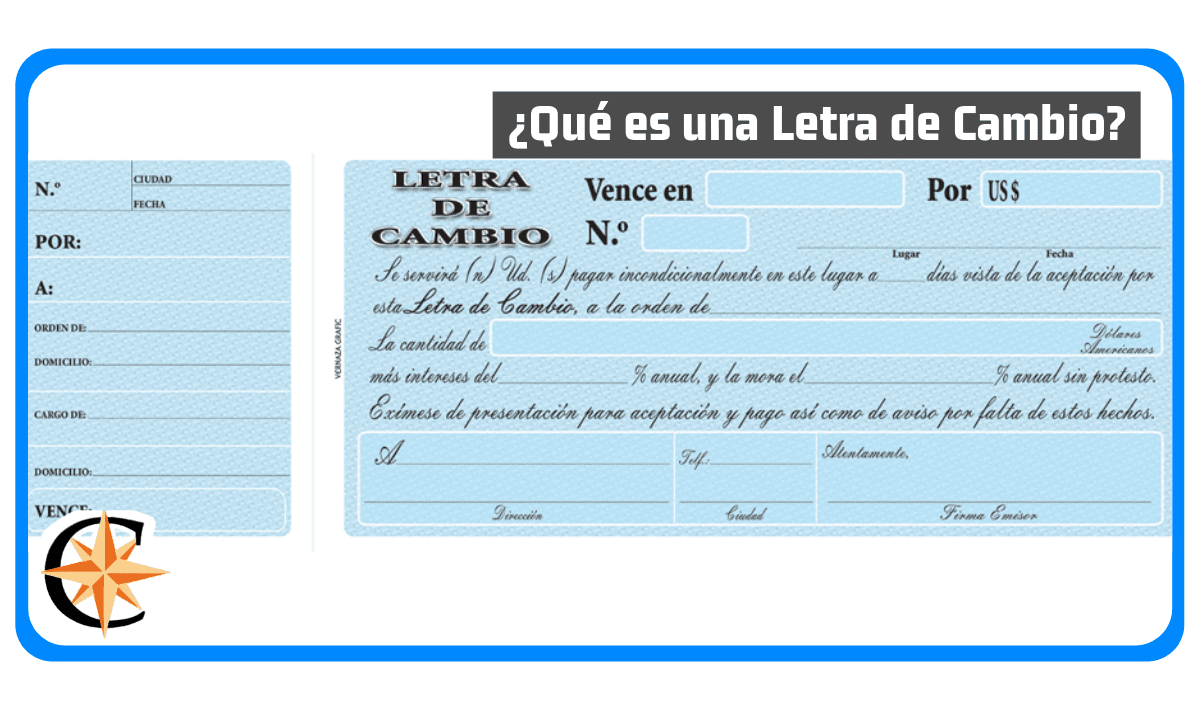

While the term might sound a bit formal and even intimidating, "un modelo de la letra de cambio" is essentially a written, unconditional order from one party (the drawer) to another (the drawee), instructing the latter to pay a specified amount of money to a third party (the payee) at a predetermined future date. Think of it as a sophisticated, legally binding IOU that has stood the test of time, facilitating trade and commerce for centuries.

The beauty of "un modelo de la letra de cambio" lies in its simplicity and versatility. It's a powerful tool that can be used in a myriad of financial transactions, from settling international trade deals to securing loans and extending credit. Its enduring relevance in today's digital age is a testament to its inherent strength and adaptability, making it an essential concept for anyone looking to navigate the intricacies of the global marketplace.

But "un modelo de la letra de cambio" is more than just a financial instrument; it represents a legacy of trust and collaboration, a testament to humanity's ingenuity in finding elegant solutions to complex challenges. It's a reminder that even in a world driven by technology, the foundations of successful transactions still lie in clear communication, mutual respect, and a shared understanding of value.

Advantages and Disadvantages of "Un Modelo de la Letra de Cambio"

| Advantages | Disadvantages |

|---|---|

| Facilitates international trade | Risk of non-payment by the drawee |

| Provides a clear payment schedule | Requires a thorough understanding of the legal framework |

| Can be used as a credit instrument | Can be subject to fraud if not handled carefully |

While "un modelo de la letra de cambio" offers numerous benefits, it is essential to consider both its strengths and limitations to make informed financial decisions. Understanding the potential risks and mitigating them through careful due diligence and adherence to best practices is crucial for leveraging this powerful tool effectively.

In conclusion, "un modelo de la letra de cambio" might seem like a relic of a bygone era, but its principles of trust, transparency, and efficiency continue to hold immense value in today's fast-paced, globalized economy. As we navigate the ever-evolving landscape of international trade and finance, understanding and embracing tools like "un modelo de la letra de cambio" can empower businesses and individuals alike to forge stronger connections, streamline transactions, and unlock new avenues for growth and prosperity.

Bank authorization form wells fargo a deep dive

Conquer crawl space chaos your ultimate guide to crawl space insulation

Dog eyeglasses protecting your pups vision