Unlocking Banking Convenience: PNC Bank Mobile Check Deposit

In today's fast-paced world, who has time to physically visit a bank? Think about it: carving out time in your busy schedule, battling traffic, waiting in line… it all adds up. That's why so many people are embracing the digital revolution in banking, and PNC Bank's mobile check deposit feature is a prime example of this shift. Let's delve into the world of remote check depositing with PNC and discover how it can simplify your financial life.

Imagine this: you just received a check, but you're nowhere near a PNC branch. Instead of putting it aside and risking forgetting about it, you simply pull out your phone, snap a couple of pictures, and voila! The check is deposited, right from the comfort of your home, office, or wherever you happen to be. This is the power of PNC Bank check deposit by phone, also known as mobile check deposit. It's a game-changer for busy individuals and businesses alike.

Mobile check deposit through PNC Bank's app offers a streamlined and secure way to manage your finances. It eliminates the need for physical trips to the bank, saving you valuable time and effort. This feature has become increasingly popular due to its ease of use and accessibility. But how does it work, and what are the key benefits? Let's explore the ins and outs of PNC's remote check depositing capabilities.

While the exact origins of mobile check deposit are complex and involve various technological advancements, it's safe to say that it's a relatively recent innovation in the banking industry. The rise of smartphones and secure imaging technology paved the way for this convenient feature. PNC Bank has been at the forefront of adopting and refining this technology, offering customers a reliable and efficient way to deposit checks remotely. This evolution reflects the bank's commitment to providing innovative solutions that meet the evolving needs of its customer base.

The importance of PNC's mobile check deposit feature cannot be overstated. In a world where convenience and efficiency are paramount, this service allows customers to manage their finances on their own terms. It empowers individuals and businesses to deposit checks anytime, anywhere, eliminating the constraints of traditional banking hours and physical branch locations. This flexibility is particularly beneficial for those who live in rural areas with limited access to branches, or for those with demanding schedules who simply can't find the time to make a trip to the bank.

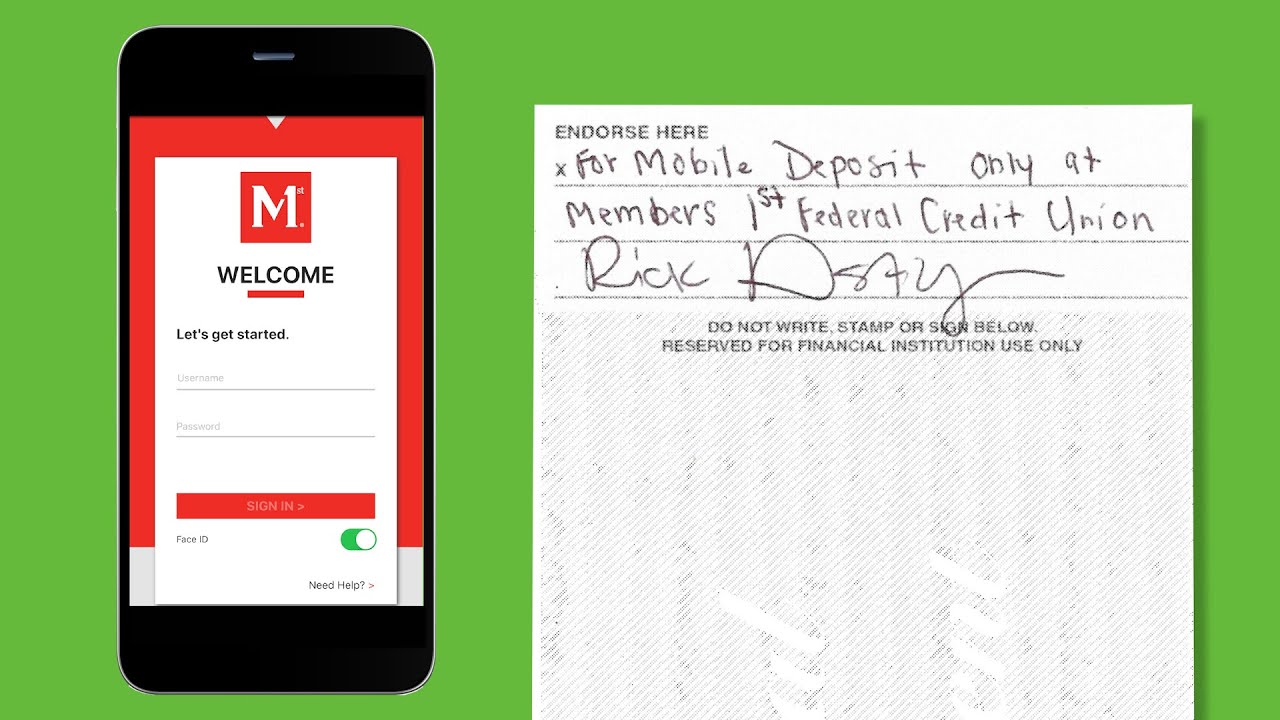

PNC mobile check deposit is the process of depositing checks into your PNC account using your smartphone or tablet and the PNC Bank mobile app. You simply endorse the check, take pictures of the front and back, and submit it through the app. It's that easy!

Benefits of PNC Bank Mobile Check Deposit:

1. Time Savings: Skip the trip to the bank and deposit checks in minutes.

2. Convenience: Deposit checks anytime, anywhere, 24/7.

3. Improved Funds Availability: Faster access to your funds compared to mailing or physically depositing checks.

Advantages and Disadvantages of PNC Bank Mobile Check Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience | Potential technical issues (e.g., app malfunctions, poor image quality) |

| Time-saving | Check deposit limits |

| 24/7 Access | Requires a compatible smartphone and internet access |

Best Practices:

1. Ensure good lighting and clear images of the check.

2. Endorse the check properly.

3. Verify deposit confirmation within the app.

4. Keep the physical check for a few days after deposit as a backup.

5. Update the app regularly for optimal performance.

Frequently Asked Questions:

1. What is the daily deposit limit for mobile check deposit? (Answer: This varies, check the PNC website or app for specific limits.)

2. What types of checks are eligible for mobile deposit? (Answer: Most checks are accepted, but there may be restrictions on certain types, such as international checks.)

3. What if I experience issues with the app? (Answer: Contact PNC customer service.)

4. How long does it take for a mobile deposit to clear? (Answer: Typically within 1-2 business days.)

5. Is mobile check deposit secure? (Answer: Yes, PNC utilizes advanced security measures to protect your information.)

6. Can I deposit multiple checks at once? (Answer: Yes, you can typically deposit multiple checks in a single session.)

7. What should I do with the physical check after depositing it through the app? (Answer: Store it securely for a short period, typically a few days, then shred it.)

8. How do I enroll in mobile check deposit? (Answer: You'll need to download the PNC Bank mobile app and enroll in the service through the app interface.)

Tips and Tricks: Flatten the check on a dark, non-reflective surface before taking pictures. Double-check the entered amount for accuracy.

In conclusion, PNC Bank's mobile check deposit feature is a powerful tool for managing your finances in today's digital age. Its convenience, speed, and accessibility make it a valuable asset for individuals and businesses alike. While there might be occasional technical hiccups, the benefits far outweigh the drawbacks. By embracing mobile check deposit, you can streamline your banking experience, save valuable time, and gain greater control over your finances. Download the PNC Bank app today and experience the future of banking at your fingertips. Take advantage of this innovative feature and discover how it can simplify your financial life. Start depositing checks from anywhere, at any time, and free yourself from the constraints of traditional banking.

Decoding the allure of epic pop love songs

Funny memes for dads

The twisted wires of fnaf fanfiction exploring michael and charlies digital afterlife