Unlock Your Home's Potential: Exploring Bank of America Home Equity Loan Rates

Your house. It’s more than just a place to hang your hat. It’s a significant investment, a store of potential value waiting to be tapped. What if you could unlock that potential to fund a major renovation, consolidate high-interest debt, or finance a dream project? That's where Bank of America home equity loans enter the picture. But navigating the landscape of home equity lending can feel like traversing a dense forest. Fear not, intrepid homeowner! This guide will illuminate the path, offering a clear view of Bank of America home equity loan rates and everything you need to know.

Understanding Bank of America's approach to home equity financing is crucial. Their rates, like those of other lenders, fluctuate based on various factors, including market conditions and your creditworthiness. While we can't provide specific, real-time rates here (those change faster than a chameleon in a rainbow factory!), we can equip you with the knowledge to find and evaluate them. Thinking about leveraging your home's equity? Knowing where to look and what questions to ask is half the battle.

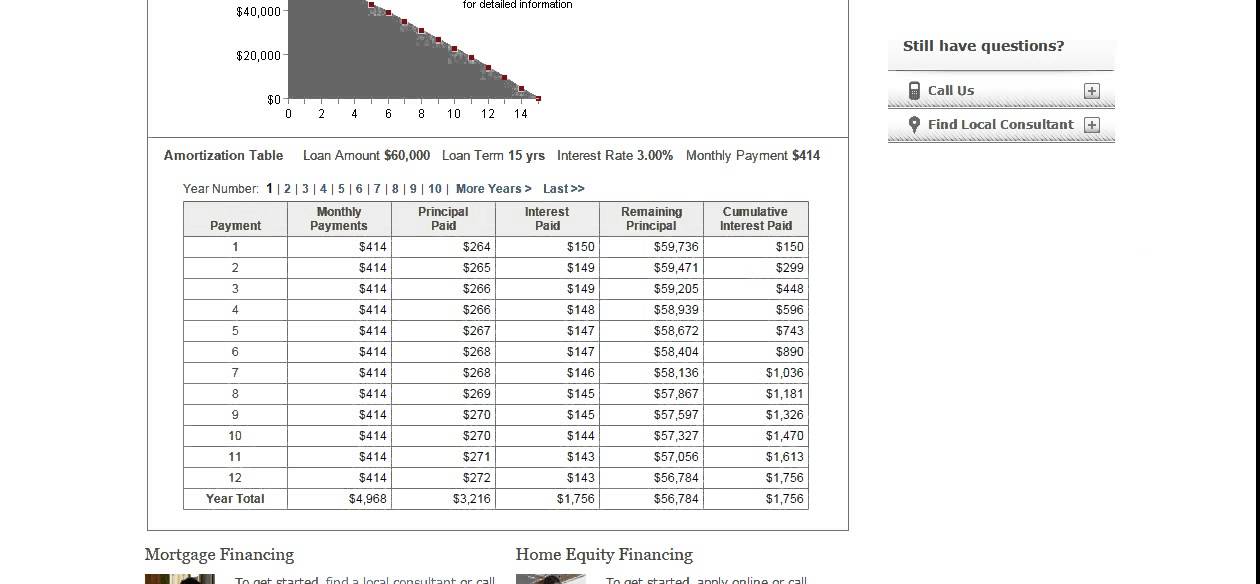

Historically, home equity loans have provided homeowners with a way to access the value they’ve built in their property. These loans, often referred to as second mortgages, offer a lump sum of money at a fixed interest rate, providing predictable monthly payments. The importance of understanding these rates lies in their impact on your overall financial well-being. A lower rate translates to lower monthly payments and less interest paid over the life of the loan. Conversely, a higher rate can significantly increase the cost of borrowing.

One of the main issues related to Bank of America home equity loans, and home equity loans in general, is the potential for increased debt. It's essential to borrow responsibly and ensure you can comfortably afford the monthly payments. Failing to do so can put your home at risk. So, before you dive in, carefully consider your financial situation and long-term goals. Think of it like this: you wouldn't scale Mount Everest without the proper gear and training. Similarly, taking on a home equity loan requires careful planning and preparation.

A Bank of America home equity loan essentially allows you to borrow against the equity in your home, using your house as collateral. Equity represents the difference between your home's current market value and the outstanding balance on your mortgage. For example, if your home is worth $300,000 and you owe $150,000 on your mortgage, you have $150,000 in equity. Bank of America, like other lenders, typically allows you to borrow a certain percentage of this equity.

One benefit of a home equity loan is the potential for debt consolidation. High-interest credit card debt can feel like a lead weight around your ankles. A home equity loan, with its typically lower interest rate, can help you consolidate that debt into a single, more manageable monthly payment. Another advantage is the potential tax deductibility of interest paid on home equity loans used for home improvements (consult a tax advisor for details). Finally, the fixed interest rate provides predictability, allowing you to budget effectively.

Advantages and Disadvantages of Bank of America Home Equity Loans

| Advantages | Disadvantages |

|---|---|

| Potential for lower interest rates than other loan types | Risk of foreclosure if payments are missed |

| Fixed interest rates provide predictable payments | Closing costs and fees can add to the overall expense |

| Potential tax deductibility of interest (consult a tax advisor) | Increases your overall debt burden |

Frequently Asked Questions:

1. How do I find current Bank of America home equity loan rates? (Check their website or contact a loan officer.)

2. What factors influence home equity loan rates? (Credit score, loan amount, loan term, market conditions.)

3. How much can I borrow with a home equity loan? (This depends on your equity and the lender's guidelines.)

4. What are the closing costs associated with a home equity loan? (These can vary, so inquire with the lender.)

5. How long does it take to get approved for a home equity loan? (This varies depending on the lender and your individual circumstances.)

6. Can I use a home equity loan for any purpose? (Generally, yes.)

7. What happens if I miss a payment on my home equity loan? (Contact your lender immediately to discuss options.)

8. How do I apply for a Bank of America home equity loan? (Online, by phone, or in person at a branch.)

Tips and tricks: Shop around and compare rates from multiple lenders before making a decision. Carefully review the terms and conditions of any loan agreement. Consider working with a financial advisor to determine if a home equity loan is the right choice for your situation.

Tapping into your home’s equity through a Bank of America home equity loan can be a powerful financial tool, offering opportunities for home improvement, debt consolidation, and more. However, it's crucial to understand the complexities of Bank of America home equity loan rates and the responsibilities that come with borrowing against your home. By carefully evaluating your financial situation, understanding the terms and conditions, and comparing rates from different lenders, you can make an informed decision that aligns with your long-term financial goals. Remember, responsible borrowing and careful planning are key to unlocking your home's potential without jeopardizing your financial security. Take the time to research, ask questions, and make the choice that’s right for you. Your future self will thank you.

Unlocking convenience the meijer online shopping app

Decoding the subaru lug nut thread pitch everything you need to know

Nfl week 16 espn predictions picks and insights