Unlock Your Funds Faster: Understanding Wells Fargo Mobile Deposit Available Funds

In today's fast-paced world, immediate access to funds is crucial. We rely on digital banking more than ever, especially when it comes to depositing checks. Wells Fargo, a leading financial institution, offers a convenient solution with its mobile deposit feature. But how quickly can you access those funds after depositing a check through your phone?

This article delves into the specifics of Wells Fargo mobile deposit available funds, addressing common questions and concerns. We'll explore the factors influencing fund availability, potential delays, and how to ensure a smooth and efficient deposit experience.

Imagine this: you receive a check, and instead of driving to a branch or ATM, you simply snap a picture with your smartphone. This is the convenience offered by Wells Fargo's mobile deposit feature. But the process doesn't end there; understanding when you can use those deposited funds is equally important.

The availability of funds deposited through the Wells Fargo mobile app depends on various factors, including the check amount, your account history, and the time of day you make the deposit. While some funds are typically available immediately, others might take a bit longer to process.

By understanding the nuances of Wells Fargo mobile deposit available funds, you can avoid potential financial hiccups and enjoy greater peace of mind. Let's break down everything you need to know.

Advantages and Disadvantages of Wells Fargo Mobile Deposit

Here's a table highlighting the advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Convenience of depositing checks anytime, anywhere | Potential delays in fund availability for certain checks |

| Saves time compared to visiting a branch or ATM | Deposit limits may apply |

| Typically faster access to funds than mailing checks | Requires a smartphone and internet access |

Best Practices for Using Wells Fargo Mobile Deposit

To ensure a seamless mobile deposit experience, consider these best practices:

- Endorse Your Check Properly: Sign the back of the check and write "For Mobile Deposit at Wells Fargo" above your signature.

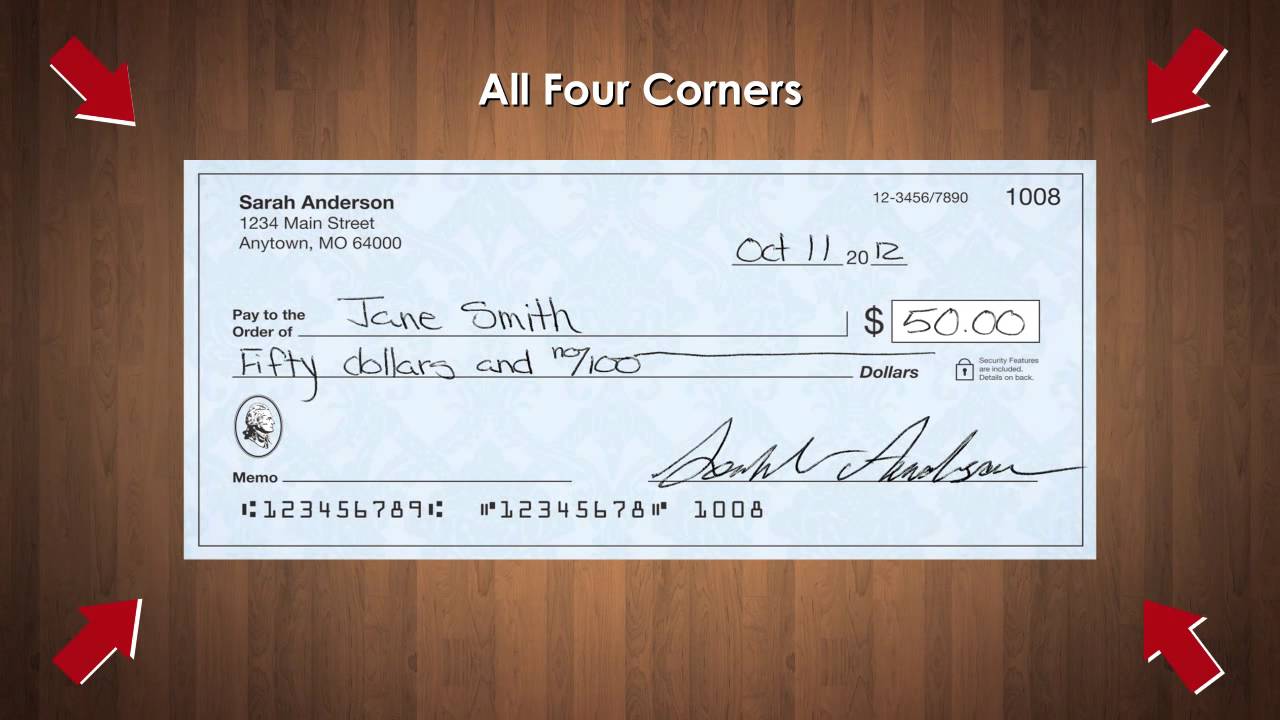

- Take Clear Photos: Capture well-lit, focused images of the front and back of the check, ensuring all four corners are visible.

- Verify Deposit Details: Double-check the deposit amount, account number, and other information before submitting.

- Keep the Original Check: Store the physical check in a safe place for a reasonable period, typically a few weeks, in case of any issues.

- Monitor Your Account: Check your account balance regularly to track fund availability and watch for any notifications from Wells Fargo.

While mobile deposit offers undeniable convenience, it's important to be aware of potential challenges and their solutions:

Common Challenges and Solutions:

- Challenge: Deposit Rejected Due to Image Quality.

Solution: Ensure proper lighting and a steady hand when taking photos. Flatten any curves on the check for a clear image. - Challenge: Funds Not Available Immediately.

Solution: Factor in potential processing times, especially for large checks or new accounts. Contact Wells Fargo if you have urgent fund needs. - Challenge: Difficulty Navigating the Mobile App.

Solution: Refer to Wells Fargo's online resources or contact customer service for assistance. - Challenge: Exceeding Mobile Deposit Limits.

Solution: Explore alternative deposit methods like ATM or branch deposits for larger amounts. - Challenge: Concerns about Security.

Solution: Utilize Wells Fargo's strong authentication methods and report any suspicious activity immediately.

Frequently Asked Questions about Wells Fargo Mobile Deposit Available Funds

Here are answers to common questions:

- Q: What is the typical hold time for checks deposited through the Wells Fargo mobile app?

A: The hold time can vary but generally, a portion of the funds is available immediately, while the full amount may take 1-2 business days to clear. - Q: Are there any limits on the amount I can deposit through mobile deposit?

A: Yes, Wells Fargo has daily and monthly mobile deposit limits. These limits vary based on factors like your account history. - Q: How can I check the status of my mobile deposit?

A: You can track your deposit status by logging into the Wells Fargo mobile app and viewing your recent transactions. - Q: What should I do if my mobile deposit is rejected?

A: Review the rejection reason in the app and try depositing again, ensuring you've followed all guidelines. If issues persist, contact Wells Fargo customer service. - Q: Can I deposit international checks via mobile deposit?

A: Currently, Wells Fargo's mobile deposit service is limited to U.S. checks drawn on U.S. banks. - Q: Is there a fee for using Wells Fargo's mobile deposit feature?

A: While the service itself is free, your mobile carrier's data rates may apply. - Q: How secure is depositing a check through the Wells Fargo mobile app?

A: Wells Fargo employs robust security measures, including encryption and multi-factor authentication, to protect your transactions.

Tips for Maximizing Wells Fargo Mobile Deposit

Consider these tips:

- Set up mobile deposit alerts to stay informed about your deposits.

- Familiarize yourself with Wells Fargo's cut-off times for mobile deposits to ensure faster processing.

- Keep your Wells Fargo app updated to access the latest features and security enhancements.

In conclusion, Wells Fargo's mobile deposit feature offers unparalleled convenience for managing your finances on the go. Understanding the nuances of fund availability, adhering to best practices, and staying informed about potential challenges empower you to utilize this service effectively. By embracing the digital banking revolution, you can streamline your financial life and focus on what matters most.

Propel therapy clintwood va your path to enhanced well being

Unlocking maximum towing power your guide to the best dodge ram 1500 for towing

Saying goodbye navigating ledger enquirer obituary submissions