Understanding Zakat Calculation for Income in Selangor

In the heart of Malaysia's most developed state, Selangor, lies a deeply rooted tradition of Islamic finance, with Zakat playing a pivotal role. Zakat, one of the five pillars of Islam, is a mandatory form of almsgiving for eligible Muslims. It serves as a system of wealth distribution and purification, ensuring social welfare and economic balance. This article aims to shed light on the method of calculating Zakat on income in Selangor (commonly known as "cara pengiraan zakat pendapatan Selangor" in Malay), providing clarity and guidance for those seeking to fulfill this significant religious obligation.

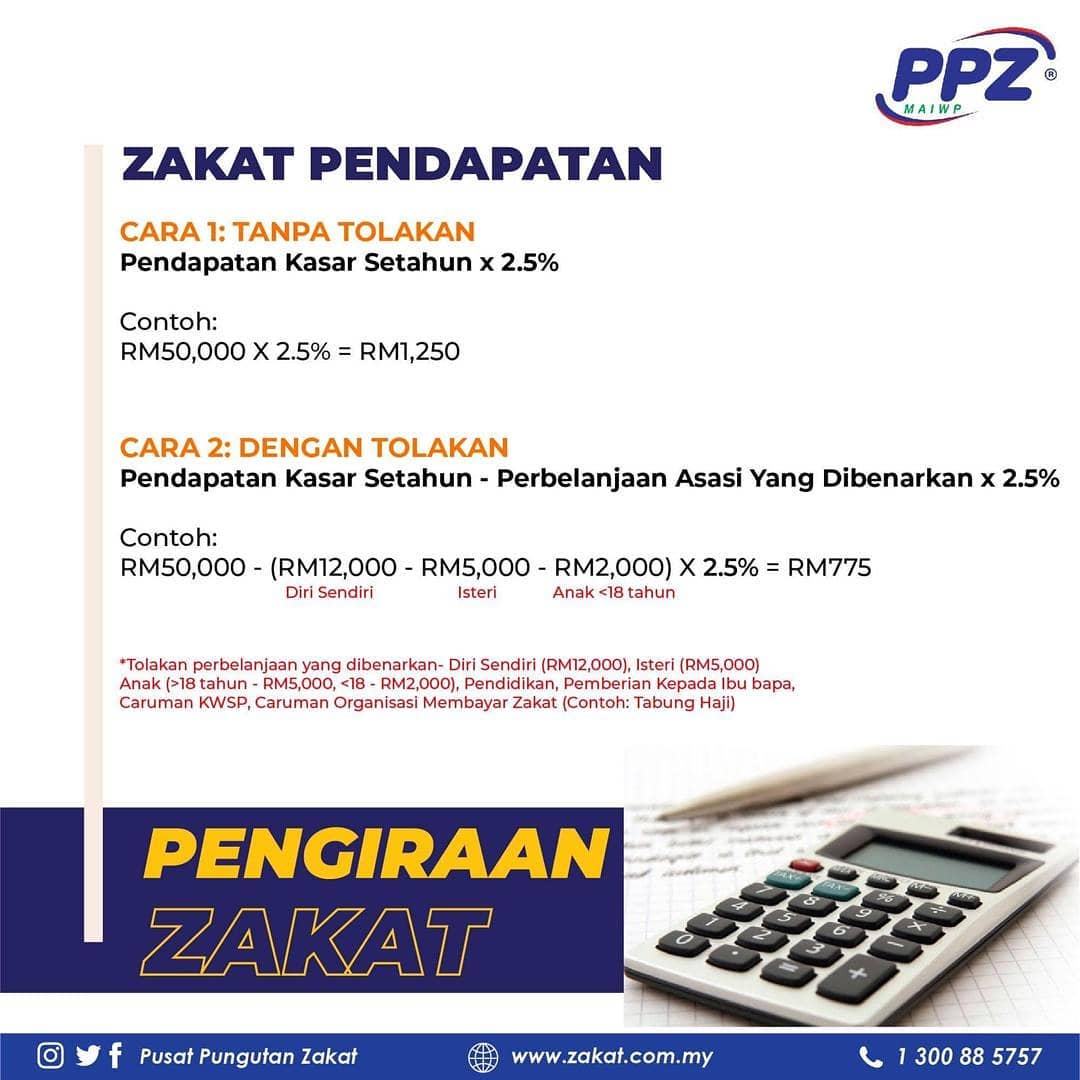

Zakat on income, as the name suggests, is calculated based on an individual's earnings. This includes salaries, wages, business profits, rental income, and any other halal sources of revenue. Understanding the "cara pengiraan zakat pendapatan Selangor," or the calculation method, is essential for Muslims residing or earning income in Selangor. The Lembaga Zakat Selangor (LZS), the religious body responsible for Zakat administration in the state, provides clear guidelines and resources to facilitate this process.

The concept of Zakat is deeply rooted in the Quran and the teachings of Prophet Muhammad (PBUH). It is a testament to the social consciousness and compassion embedded within the principles of Islam. Zakat serves as a bridge between the affluent and the less fortunate, promoting a just and equitable society.

Calculating Zakat accurately is crucial to fulfilling this religious duty. The process involves determining if one has reached the Nisab, the minimum threshold of wealth above which Zakat becomes obligatory. In the case of Zakat on income, the Nisab is determined based on the current market value of gold or silver. The LZS website provides up-to-date information on the Nisab value.

Beyond its spiritual significance, Zakat plays a crucial role in fostering economic empowerment and community development. Funds collected through Zakat are distributed among eight categories of recipients (asnaf) outlined in the Quran. These include the poor, the needy, debtors, travelers in need, and others who require assistance. This ensures that Zakat contributions directly benefit those who need it most, creating a safety net for the vulnerable and fostering a culture of support within society.

Advantages and Disadvantages of Zakat

While there are no disadvantages to fulfilling a religious obligation like Zakat, understanding its impact can offer a broader perspective:

| Advantages | Considerations |

|---|---|

| Purification of wealth | Requires accurate calculation and understanding of regulations |

| Social welfare and poverty alleviation | Individual responsibility to fulfill the obligation |

| Economic empowerment and circulation of wealth | Reliance on individual compliance and honesty in declaration of income |

Navigating the "cara pengiraan zakat pendapatan Selangor" might seem daunting initially, but the LZS has simplified the process, offering various resources like online calculators and comprehensive guides on their website. Understanding the importance of Zakat and its calculation empowers individuals to fulfill this significant pillar of Islam. By embracing the spirit of Zakat, we contribute to a more just and compassionate society, upholding the values of Islam and fostering collective well-being.

Unveiling the hierarchy a look at the dnd classes tier list 5e

The allure of a white square outline on a black background

Wells fargo home loan payoff phone number your guide to debt freedom