The Power of Proof: Mastering "Contoh Surat Tanda Terima" for Financial Freedom

Ever handed over a wad of cash and felt that little pang of doubt? Or maybe you've received a payment and wondered if a simple "thanks" was enough to truly seal the deal? In a world where we're encouraged to chase the almighty dollar, it's easy to overlook the simple yet powerful tools that can safeguard our financial well-being.

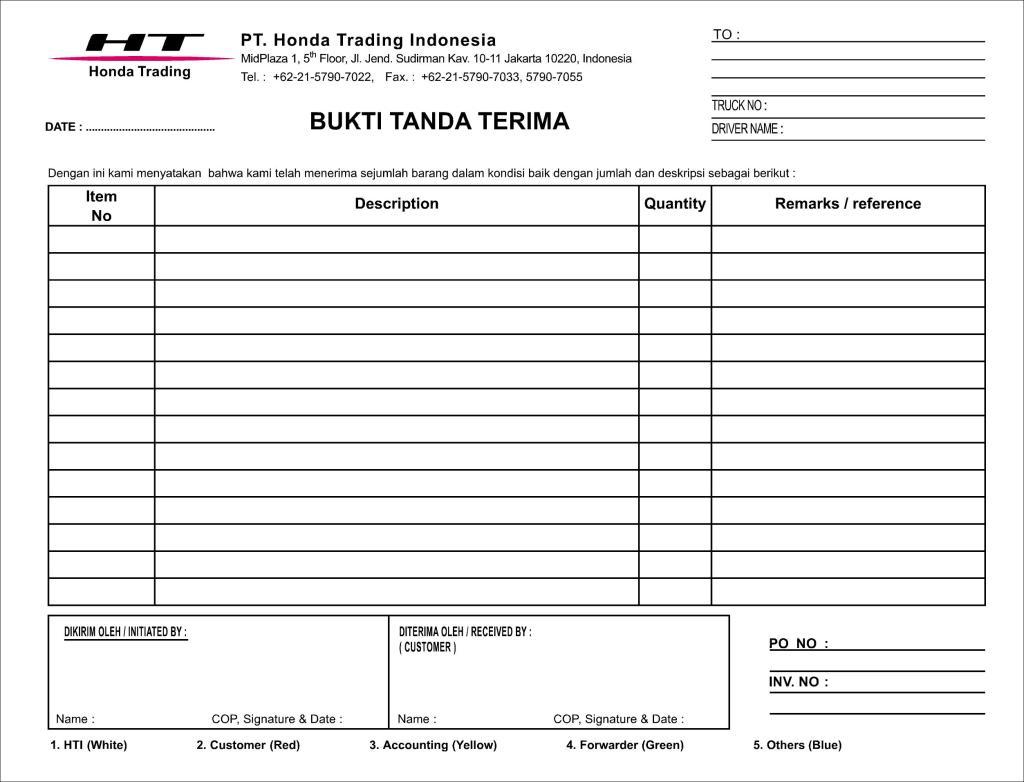

Enter the "Contoh Surat Tanda Terima" – a term that might sound like a mouthful, but trust me, it's music to your financially savvy ears. In essence, it's an official receipt of acknowledgement in Indonesian. Think of it as your financial safety net, a legally binding document that clearly outlines the exchange of goods or money between two parties.

You might be thinking, "But I live in the digital age! Do I really need a piece of paper?" Well, my friend, while technology has revolutionized many aspects of our lives, there's a certain undeniable power in a tangible record, particularly when it comes to financial matters.

Imagine this: you've been diligently saving up for a down payment on your dream tiny house (because who needs a McMansion, right?). You finally find the perfect builder and hand over a hefty sum. Months later, there's a dispute over materials used, and without a clear record of your initial payment, you're left scrambling for proof. Frustrating, right? This is where the "Contoh Surat Tanda Terima" steps in as your knight in shining armor.

But this isn't just about big-ticket items. This simple document is equally crucial for smaller transactions – lending money to a friend, paying a contractor for home repairs, or even receiving payment for a side hustle project. It's about fostering transparency, accountability, and peace of mind in all your financial dealings.

Now, you might be wondering, "This all sounds great, but what exactly goes into creating this magical document?" Don't worry, we'll dive into the nitty-gritty details later. For now, just remember this: taking control of your finances isn't about hoarding wealth, it's about making smart, strategic choices that protect your hard-earned money and give you the freedom to live life on your own terms. And the "Contoh Surat Tanda Terima" is a simple yet powerful tool to help you do just that.

Advantages and Disadvantages of "Contoh Surat Tanda Terima"

| Advantages | Disadvantages |

|---|---|

| Provides legal proof of transaction | Requires effort to create and maintain |

| Reduces the risk of disputes | May not be foolproof in case of fraud |

| Promotes transparency and accountability | Can be time-consuming for small transactions |

While the "Contoh Surat Tanda Terima" offers invaluable benefits, it's crucial to acknowledge potential drawbacks. Creating and maintaining these documents requires effort, and their effectiveness hinges on the integrity of all parties involved.

Best Practices for Utilizing "Contoh Surat Tanda Terima"

To maximize the benefits of "Contoh Surat Tanda Terima", consider these best practices:

- Always Use Written Format: While verbal agreements hold some weight, a written document provides concrete evidence.

- Detailed Information is Key: Clearly outline the date, parties involved, description of goods/services, amount exchanged, and signatures.

- Duplicate Copies: Ensure both parties retain a signed copy for their records.

- Safe Storage: Treat these documents like valuable assets and store them securely.

- Seek Legal Advice When Needed: For complex transactions or high-value items, consulting a legal professional is advisable.

By incorporating these practices, you transform the "Contoh Surat Tanda Terima" from a simple document into a powerful shield, safeguarding your financial interests. Remember, knowledge is power, and understanding this essential tool empowers you to navigate the complexities of financial transactions with confidence and clarity.

Riccar vacuum unclogging the ultimate guide

The undeniable allure of aac college football

Almond shaped nail designs inspiration and guide