Staying Ahead: Your Guide to Malaysian Company Tax Number Verification

Navigating the world of business finances can feel like stepping into a labyrinth. In Malaysia, the company tax number, much like a unique fingerprint for businesses, plays a crucial role in ensuring smooth financial operations and compliance with tax regulations. Understanding how to verify this number can save you from potential pitfalls and empower you to make informed decisions.

Think of it like this: imagine embarking on a journey without a map. You might eventually reach your destination, but the process would likely be fraught with wrong turns and unnecessary detours. Similarly, in the realm of business dealings, especially when it comes to financial matters, verifying a company tax number is akin to consulting your trusty map. It provides you with the assurance that you're heading in the right direction, dealing with legitimate entities, and minimizing the risk of encountering unpleasant surprises down the line.

Whether you're a seasoned entrepreneur or just starting out, understanding the ins and outs of company tax number verification is essential. It's not just about ticking boxes for compliance; it's about arming yourself with the knowledge to make informed decisions, protect your interests, and build a solid foundation for your business.

In this comprehensive guide, we'll delve into the intricacies of Malaysian company tax number verification. We'll explore its significance, the process involved, the benefits it offers, and address common questions that may arise along the way. Our goal is to empower you with the knowledge and tools necessary to navigate this aspect of business with confidence.

Think of this guide as your compass, guiding you through the intricacies of company tax number verification in Malaysia. By the end of this journey, you'll not only understand the "what" and "how" but also grasp the "why" – why this seemingly small step plays such a crucial role in your business journey.

Advantages and Disadvantages of Verifying Company Tax Numbers

While verifying a company's tax number offers numerous benefits, it's also essential to understand the potential drawbacks:

| Advantages | Disadvantages |

|---|---|

| Ensures compliance with tax regulations | Can be time-consuming, especially for multiple verifications |

| Reduces the risk of fraudulent activities | May require navigating government websites or portals |

| Promotes transparency and trust in business transactions | Information may not always be up-to-date, requiring additional checks |

Best Practices for Verifying Company Tax Numbers

To make the verification process smoother and more efficient, consider these best practices:

- Establish a Routine: Incorporate company tax number verification into your standard procedures for onboarding new clients, vendors, or partners. This proactive approach helps mitigate risks from the outset.

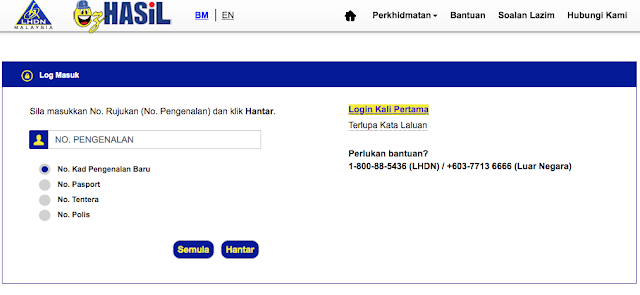

- Utilize Official Sources: Rely on reputable sources like the official website of the Inland Revenue Board of Malaysia (LHDN) for verification. Avoid relying solely on third-party platforms to ensure accuracy.

- Double-Check Information: Pay close attention to details while entering the company tax number and cross-reference it with other company information, such as the registered name and address, for consistency.

- Stay Informed: Keep abreast of any updates or changes in tax regulations or verification processes to ensure your practices remain current and compliant.

- Seek Professional Assistance: If you're dealing with a large volume of verifications or have complex situations, consider engaging the services of a qualified accountant or tax consultant. Their expertise can streamline the process and provide valuable insights.

Frequently Asked Questions about Company Tax Number Verification

Here are answers to some commonly asked questions about verifying Malaysian company tax numbers:

- Q: Where can I verify a Malaysian company tax number?

A: The most reliable source is the official website of the Inland Revenue Board of Malaysia (LHDN). - Q: Is it mandatory to verify company tax numbers?

A: While not always legally required, it's highly recommended to protect yourself from potential risks associated with non-compliant or fraudulent entities. - Q: What information do I need to verify a company tax number?

A: Typically, you'll need the company's full registered name and tax identification number.

Tips for Effortless Verification

Consider these tips to make your company tax number verification process even smoother:

- Bookmark the official LHDN website for quick access.

- Explore if the LHDN offers any mobile applications or digital tools to simplify verification.

In conclusion, just as you wouldn't embark on a journey without consulting a map, venturing into business dealings without verifying company tax numbers can lead you down a risky path. By understanding the importance of this process, the steps involved, and the benefits it offers, you equip yourself to make informed decisions that protect your interests and contribute to the smooth operation of your business. Remember, knowledge is power, and in the world of business finances, verifying company tax numbers is a powerful tool to have in your arsenal.

Thinking of enlisting what tattoos are allowed for army recruits

Upgrade your ride finding subwoofer installation near you

Making sense of online discussion a rubric for students