Need a JPMorgan Chase Bank Routing Number in CT? Your Guide Here

Dealing with financial transactions in Connecticut? Knowing the right routing number for your bank is crucial. This guide dives deep into the JPMorgan Chase bank routing number for CT, offering a comprehensive understanding of its significance and practical applications.

Whether you're setting up direct deposit, making online payments, or wiring funds, using the correct routing number ensures smooth and hassle-free transactions. This seemingly small nine-digit code plays a big role in identifying the financial institution involved. For JPMorgan Chase customers in Connecticut, having the right information is essential.

Understanding the JPMorgan Chase routing number in CT goes beyond simply knowing the digits. It's about understanding its function within the larger financial ecosystem. This guide breaks down the complexities, providing clarity and practical advice for individuals and businesses alike.

Navigating the world of banking can be daunting. With so many numbers and codes to remember, it's easy to get confused. This comprehensive resource aims to simplify the process, offering valuable insights into the JPMorgan Chase bank routing number for CT. You'll learn how to locate it, when to use it, and how to avoid potential issues.

This guide is designed to be your go-to resource for everything related to the JPMorgan Chase bank routing number in CT. From basic definitions to advanced tips and tricks, you'll find all the information you need in one convenient location. Let's dive in!

The routing number system evolved with the growth of the banking industry in the United States. It's a key component of the Automated Clearing House (ACH) network, facilitating electronic transactions nationwide. Each bank has a unique routing number, ensuring that funds are directed to the correct institution.

The JPMorgan Chase bank routing number for CT is essential for various banking operations. It's used for direct deposit, automatic bill payments, wire transfers, and other crucial transactions. Without the correct routing number, transactions can be delayed, rejected, or even misdirected.

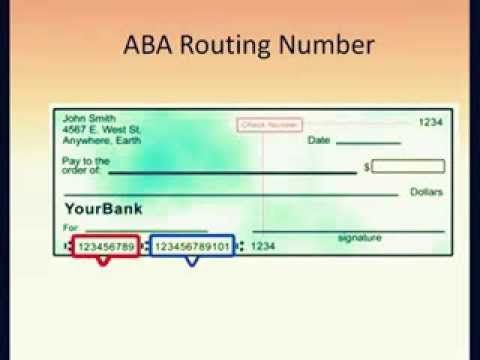

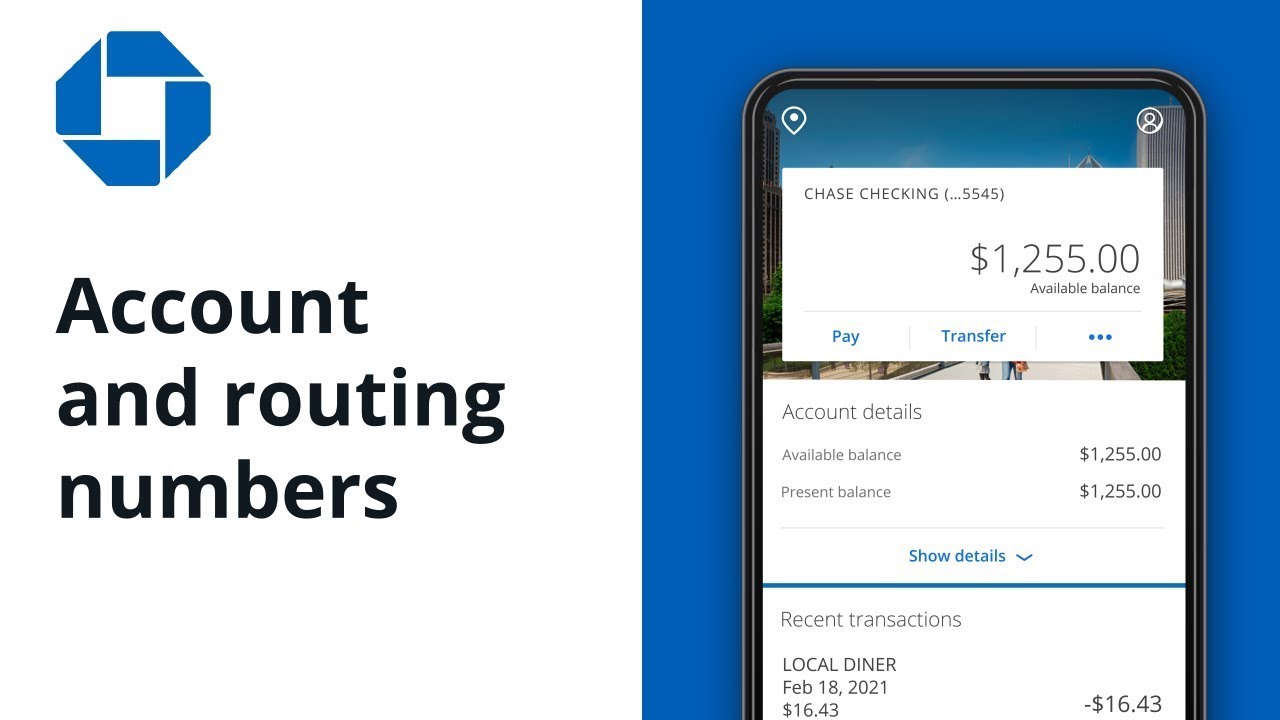

Locating your JPMorgan Chase bank routing number in CT is often as simple as checking your checkbook. It's typically printed at the bottom left of your checks. You can also find it on your online banking platform or by contacting customer service.

One benefit of knowing your routing number is the ability to set up direct deposit. This allows your paycheck to be automatically deposited into your account, eliminating trips to the bank. Another benefit is the convenience of automatic bill payments. You can schedule recurring payments, ensuring you never miss a due date. Finally, knowing your routing number is crucial for wire transfers, allowing you to send and receive money quickly and efficiently.

While specific real-world examples involving individual account details are confidential, consider scenarios like setting up direct deposit with a Connecticut-based employer, making online bill payments to a utility company in CT, or initiating a wire transfer from a JPMorgan Chase account in Connecticut to another financial institution.

Advantages and Disadvantages of Knowing Your Routing Number

| Advantages | Disadvantages |

|---|---|

| Enables seamless electronic transactions | Potential for fraud if the number falls into the wrong hands |

| Facilitates convenient online banking | Requires careful handling and secure storage |

Best practices for using your routing number include keeping it confidential, verifying its accuracy before initiating transactions, and regularly monitoring your bank statements for any unauthorized activity. It's crucial to be cautious about sharing your routing number online or over the phone.

Frequently asked questions about routing numbers often include: What is it? Where can I find it? What's the difference between a routing number and an account number? How is it used for different transactions? What should I do if I suspect fraudulent activity? It's important to understand these basic aspects of routing numbers for secure and efficient banking.

One helpful tip is to save your routing number in a secure digital location, like a password manager, for easy access. Always double-check the number when making online transactions to avoid errors.

In conclusion, the JPMorgan Chase bank routing number for CT is a fundamental piece of information for anyone holding an account with this institution in Connecticut. Understanding its purpose, knowing where to find it, and practicing safe handling procedures ensures smooth and secure financial transactions. This knowledge empowers you to effectively manage your finances and take advantage of convenient banking services. From setting up direct deposit to making online payments, having the correct routing number is essential. Take the time to familiarize yourself with this crucial piece of information and keep it secure. It's a small detail that plays a significant role in your financial life.

Unleash your dark side exploring evil pictures to draw

Level up your imagination exploring the world of pokemon fanfiction oc gamers

Jeff wagner wtmj radio