Navigating the Landscape of Medicare Plan B Expenses

Within the intricate tapestry of healthcare choices, Medicare Plan B emerges as a crucial thread for many Americans nearing retirement. It promises a safety net, a promise of care when we need it most. But like any significant decision, understanding the financial implications – the Medicare Plan B cost – is paramount. How do we navigate this complex landscape and ensure we're making informed choices for our future well-being?

Understanding the price tag associated with Medicare Plan B isn't just about crunching numbers; it's about understanding the value it offers. It's about weighing the potential out-of-pocket expenses against the peace of mind that comes with knowing we have access to essential medical services. It’s a journey of exploration, a process of piecing together the puzzle of coverage, deductibles, and premiums.

The historical context of Medicare Plan B provides valuable insights into its current structure. Born from the recognition of a growing need for accessible healthcare for older adults, it has evolved over time, reflecting the changing needs and challenges of our aging population. Understanding this evolution helps us appreciate the complexities of the system and the ongoing efforts to refine and improve its affordability and effectiveness.

The importance of Medicare Plan B lies in its ability to provide crucial coverage for a range of medical services, from doctor visits and outpatient care to preventive services and necessary medical equipment. It fills a vital gap in healthcare coverage, offering a degree of financial protection against unforeseen medical expenses. However, navigating the intricacies of the plan's cost structure can often feel like traversing a labyrinth.

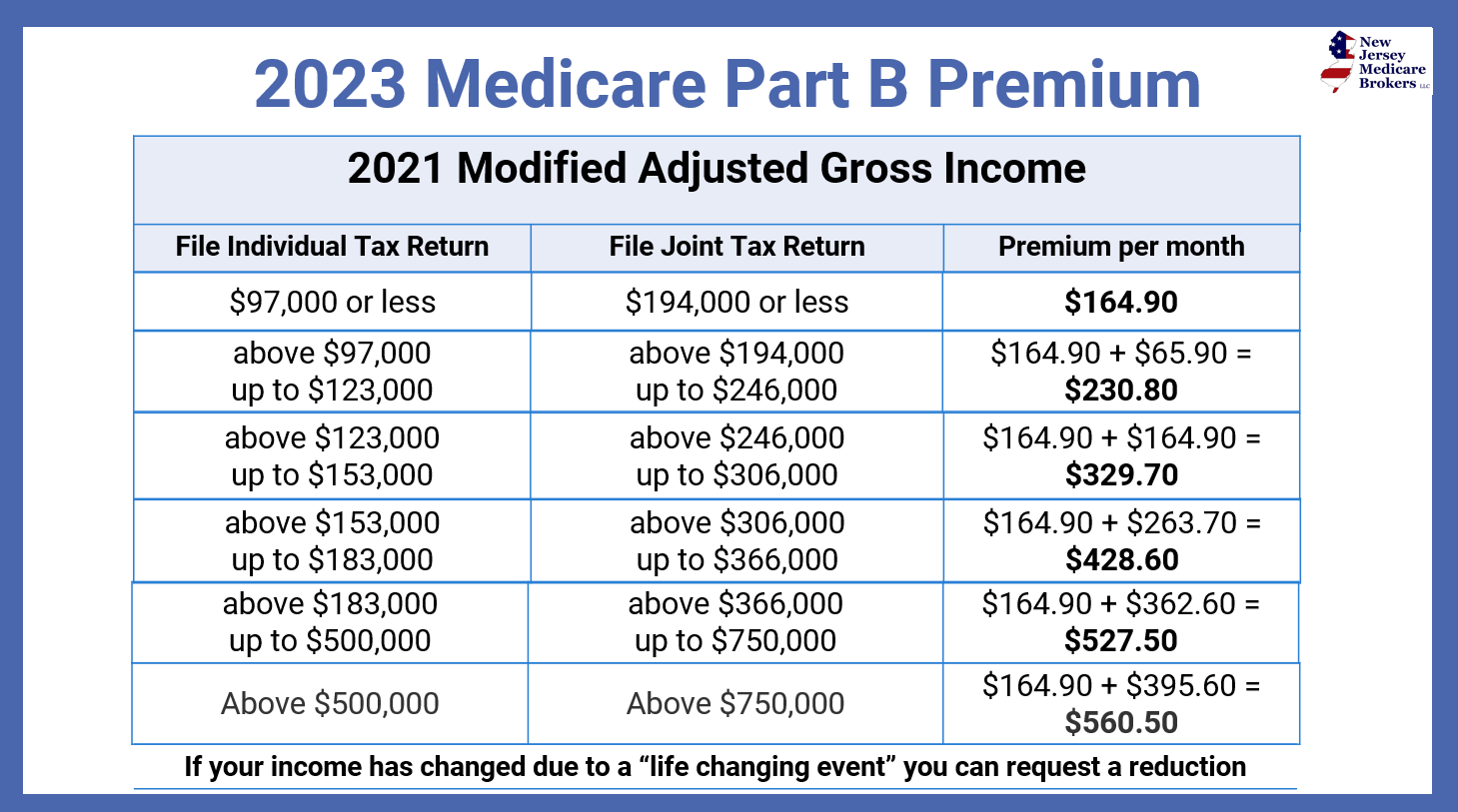

One of the central challenges associated with Medicare Plan B cost is its variability. Premiums can fluctuate based on income, and deductibles can impact the amount individuals pay out-of-pocket. Understanding these variables is crucial for accurate budgeting and financial planning. It necessitates careful consideration of one's individual circumstances and proactive exploration of available resources and assistance programs.

Medicare Plan B premiums are typically deducted directly from Social Security benefits. The standard monthly premium for 2024 is $164.90, but this amount can be higher based on income. The annual deductible for Medicare Plan B in 2024 is $226. After meeting the deductible, Medicare Plan B generally covers 80% of the Medicare-approved amount for covered services, leaving the beneficiary responsible for the remaining 20% coinsurance.

Three key benefits of having Medicare Plan B include: access to a broad range of medically necessary services, preventive care coverage that helps detect and manage health issues early, and the peace of mind that comes with knowing you have financial protection against unexpected medical costs.

Advantages and Disadvantages of Medicare Plan B

| Advantages | Disadvantages |

|---|---|

| Access to a wide range of medical services | Monthly premiums and an annual deductible |

| Preventive care coverage | 20% coinsurance for most services |

| Financial protection against unexpected medical expenses | Doesn't cover all medical expenses (e.g., vision, dental, long-term care) |

Frequently Asked Questions about Medicare Plan B Costs:

1. How is the Medicare Plan B premium determined? (Answer: Based on income)

2. What is the Medicare Plan B deductible? (Answer: $226 in 2024)

3. What percentage of costs does Medicare Plan B cover after the deductible? (Answer: 80%)

4. How do I enroll in Medicare Plan B? (Answer: Through Social Security)

5. Can I appeal a Medicare Plan B coverage decision? (Answer: Yes, there is an appeals process.)

6. Are there programs to help with Medicare Plan B costs? (Answer: Yes, programs like Medicare Savings Programs (MSPs) may be available.)

7. Does Medicare Plan B cover prescription drugs? (Answer: No, that's Medicare Part D)

8. Does Medicare Plan B cover long-term care? (Answer: No.)

One tip for managing Medicare Plan B costs is to explore Medicare Savings Programs if you have limited income and resources. These programs can help pay for premiums, deductibles, and coinsurance.

In conclusion, navigating the terrain of Medicare Plan B cost requires careful consideration and proactive planning. Understanding the intricacies of premiums, deductibles, and coverage is essential for making informed decisions that align with your individual healthcare needs and financial situation. While the landscape may appear complex, the benefits of having access to crucial medical services and the peace of mind it provides make the journey worthwhile. By actively engaging with the available resources and seeking guidance when needed, you can effectively manage your Medicare Plan B expenses and ensure access to the care you need, when you need it most. This proactive approach empowers individuals to take control of their healthcare journey and secure a healthier, more secure future. Take the time to research, understand, and plan for your Medicare Plan B costs. Your future self will thank you.

Wells fargo bank checking account options navigating the stagecoach to financial serenity or not

Mastering mercedes sprinter 2500 lug nut torque a comprehensive guide

Sae equivalent to 18mm what wrench fits