Is Accrual Basis GAAP Right For Your Business?

Imagine this: you're holding an ice cream cone on a hot summer day. You wouldn't wait until the ice cream melts all over your hand to say you've experienced it, right? You acknowledge the deliciousness (and potential mess) as it's happening. That's the essence of accrual accounting, a fundamental principle within Generally Accepted Accounting Principles (GAAP). But is accrual basis GAAP the right fit for your business?

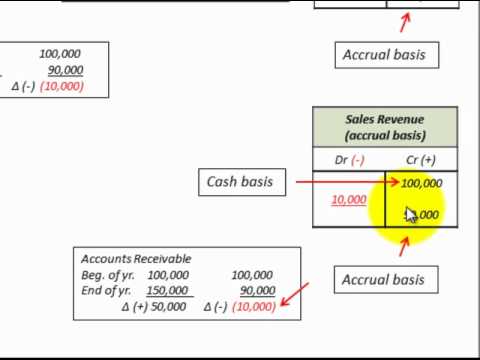

In the world of accounting, there are two primary methods: cash basis and accrual basis. Cash basis accounting is like keeping track of your spending money – you record transactions when cash changes hands. Accrual accounting, on the other hand, paints a more complete picture. It recognizes revenue when it's earned and expenses when they're incurred, regardless of when the actual cash flow occurs.

Now, where does GAAP come in? GAAP is like the rulebook for accounting in the United States. It sets standards for how businesses should record and report their financial information. And guess what? GAAP generally prefers the accrual basis of accounting. Why? Because it provides a more accurate representation of a company's financial health, especially for businesses that operate on credit or have complex transactions.

Think about it – wouldn't you want to know if a customer owes you a significant amount of money, even if they haven't paid you yet? Or if you've incurred expenses but haven't received the bill? Accrual basis GAAP ensures these elements are reflected in your financial statements, giving you a clearer picture of your profitability and overall financial position.

Understanding the ins and outs of accrual basis GAAP is crucial for making informed business decisions. Whether you're a seasoned entrepreneur or just starting out, grasping this concept can have a significant impact on your financial clarity and long-term success. In this article, we'll delve deeper into the world of accrual basis GAAP, exploring its benefits, potential drawbacks, and how it can empower you to make smarter financial choices.

Advantages and Disadvantages of Accrual Basis GAAP

Here's a table summarizing the advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Provides a more accurate picture of a company's financial health. | Can be more complex to implement and maintain. |

| Offers a long-term perspective on financial performance. | May not reflect immediate cash flow situation. |

| Essential for securing loans or investments. | Requires diligent record-keeping and reconciliation. |

Best Practices for Implementing Accrual Basis GAAP

Let's explore some best practices to make the transition smoother:

- Invest in accounting software: Ditch the spreadsheets! Robust accounting software can automate many accrual accounting tasks.

- Establish clear billing and payment terms: This makes it easier to track and reconcile invoices and payments.

- Reconcile bank statements regularly: Catching discrepancies early is key to maintaining accurate records.

- Seek professional guidance: Don't be afraid to consult with a certified public accountant (CPA) for personalized advice.

- Stay updated on GAAP changes: Accounting standards evolve, so staying informed is crucial for compliance.

While navigating the intricacies of accrual basis GAAP might seem daunting, remember that you don't have to go it alone. By embracing these best practices and seeking expert guidance when needed, you can unlock the power of accurate financial reporting and pave the way for a brighter, more financially secure future for your business.

Navigating disputes mediator designation notices

Renew your us passport a comprehensive guide

Unlocking the power of human skull drawings a comprehensive guide