How to Endorse a Check Over to Someone Else: A Complete Guide

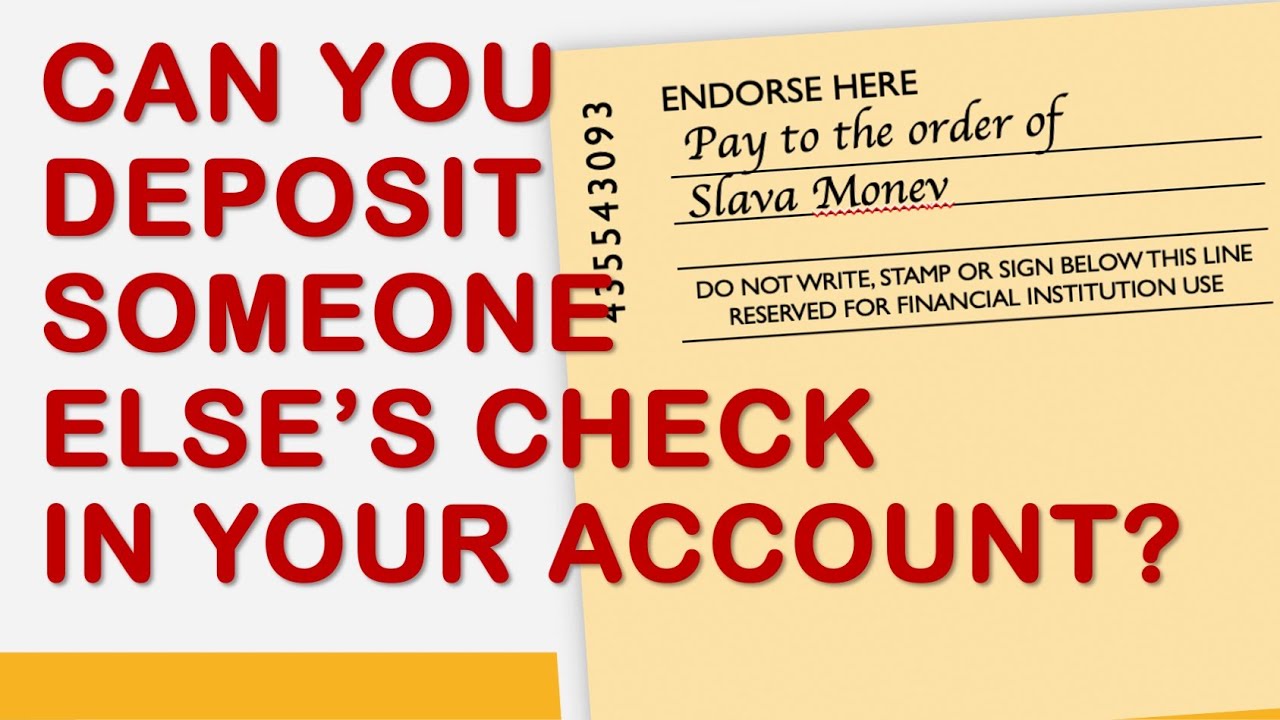

Let’s face it, in today's digital age, paper checks can feel like relics from a bygone era. But they're still floating around, and there might be times when you need to transfer a check made out to you to someone else. Maybe a friend is covering a shared expense, or you owe money to someone and want to use a check that's been made out to you. Whatever the reason, knowing how to properly endorse a check over to someone else is crucial for a smooth and secure transaction.

It might seem simple enough, right? Just sign the back. But there's a bit more to it than that. Without the correct process, you could encounter delays, risk the security of your funds, or even render the check useless. This guide is here to equip you with all the knowledge you need to confidently navigate this process.

We'll break down the steps, demystify the terminology, and provide clear examples to guide you. We'll also delve into the potential pitfalls to watch out for and offer practical tips to ensure your transaction goes off without a hitch. So, let's dive in and explore the intricacies of endorsing a check over to someone else.

Before we get started, it's important to note that financial regulations can vary depending on your location. While the general principles of endorsing a check over to someone else remain relatively consistent, it's always a good idea to check with your bank or financial institution for any specific rules or restrictions that may apply in your area.

With that said, let's unravel the mystery of endorsing a check over to someone else together. By the end of this guide, you'll be equipped with the knowledge and confidence to handle these transactions like a pro. Whether you're new to this or simply need a refresher, we've got you covered.

Advantages and Disadvantages of Endorsing a Check Over to Someone Else

Endorsing a check over to someone else, while convenient, comes with its own set of advantages and disadvantages. Understanding these can help you make informed decisions and mitigate potential risks.

| Advantages | Disadvantages |

|---|---|

| Convenience and Speed | Security Risks |

| Simple Process | Limited Control |

| Useful for Debt Settlement | Potential for Disputes |

Best Practices for Endorsing a Check Over to Someone Else

To ensure a smooth and secure transaction when endorsing a check over to someone else, consider these best practices:

- Verify Check Details: Before endorsing, double-check the payee's name, amount, and date to avoid any discrepancies.

- Use the Correct Endorsement: As explained earlier, choose between a blank endorsement or a restrictive endorsement based on your comfort level and trust in the recipient.

- Communicate with the Recipient: Inform the person you're endorsing the check to about the process and any potential delays.

- Consider Alternatives: If you're unsure about endorsing a check, explore alternative payment methods like mobile payments or bank transfers for added security and convenience.

- Keep Records: For your records, note the check number, date, amount, and the name of the person you endorsed it to. This can be helpful in case of any future discrepancies or disputes.

Common Questions and Answers About Endorsing Checks

Let's address some frequently asked questions about endorsing checks over to someone else:

Q1: Can I endorse a check over to someone else if it's made out to both me and another person?

A1: In cases where a check is made out to multiple payees, all parties listed on the check need to endorse it for it to be valid.

Q2: Is it legal to endorse a check over to a business?

A2: Yes, you can endorse a check over to a business. Ensure you write the correct and legal business name in the endorsement area.

Q3: What happens if I make a mistake while endorsing the check?

A3: It's best to avoid writing anything other than the required endorsements on the back of the check. If you make a mistake, contact your bank for guidance. They might advise you to request a new check from the issuer.

Q4: Can I endorse a check to someone else at an ATM or through mobile deposit?

A4: Generally, no. ATMs and mobile deposit services typically don't allow for endorsing checks to other parties. These methods are designed for depositing checks into your own account.

While paper checks might seem like a relic of the past, they still play a role in today's financial landscape. Knowing how to properly endorse a check over to someone else equips you with the flexibility to navigate various financial situations. By following the steps, understanding the risks, and implementing the best practices outlined in this guide, you can confidently handle check endorsements with ease and security.

Unlocking iowas incremental salary growth

Us womens soccer olympic team journey

Craving sun sand and romance your guide to love island uk season 4

:max_bytes(150000):strip_icc()/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)

:max_bytes(150000):strip_icc()/instructions-and-problems-with-signing-a-check-over-315318-final-a7d51331576c42a6ab3cac0eb683901d.jpg)