Giants of Industry: Exploring Today's Top Companies by Market Value

Ever wonder which companies hold the most weight in the global economy? It's a fascinating question, and the answer shifts with the tides of innovation, consumer demand, and global events. Today's most valuable companies by market capitalization represent a snapshot of current economic powerhouses, reflecting where investors are placing their bets on future growth and success.

Market capitalization, often shortened to "market cap," is a simple yet powerful metric. It represents the total value of a publicly traded company's outstanding shares. Calculated by multiplying the current share price by the total number of shares, it provides a readily accessible way to compare the relative size and value of different companies. Think of it as a collective vote of confidence from investors, a gauge of how much they believe a company is worth.

The companies leading the pack in terms of market cap often become household names, influencing not only our investment portfolios but also our daily lives. From the technology we use to the products we consume, these giants shape our world in profound ways. Understanding their trajectories, their strengths, and the challenges they face offers valuable insights into the broader economic landscape.

Tracking the biggest companies by market cap isn't just about admiring their size; it's about understanding the forces driving the modern economy. Which industries are thriving? What innovations are capturing the imagination of investors? These are the questions that the list of top companies helps us answer, revealing trends and shifts that can impact us all.

Historically, the composition of the top companies by market cap has evolved dramatically. From industrial giants to tech behemoths, the leading players reflect the changing nature of business and innovation. This dynamic landscape offers a fascinating glimpse into economic history and the forces that shape market leadership.

The importance of these leading companies lies in their significant impact on the global economy. They employ millions, drive innovation, and influence government policies. Their activities have ripple effects across industries, affecting everything from supply chains to consumer spending. Understanding their strategies and operations is crucial for navigating the modern business world.

A key issue surrounding these highly valued companies is their potential for market dominance. While competition is generally seen as a positive force, the sheer size and influence of these giants raise concerns about fair competition and the potential stifling of smaller businesses. Regulators and policymakers grapple with finding the right balance between fostering innovation and preventing monopolies.

One simple example of market cap in action: Imagine Company A has 1 million shares outstanding, and each share is currently trading at $100. Its market cap would be $100 million. If positive news about the company leads to its share price rising to $150, its market cap would jump to $150 million, reflecting the increased investor confidence.

A benefit of focusing on top market cap companies for investment is their perceived stability. While not immune to market fluctuations, these companies often have established business models and diverse revenue streams, which can offer a sense of security to investors. Another benefit is their potential for growth. While already large, these companies often continue to innovate and expand, offering opportunities for long-term investment returns. Finally, many of these companies pay dividends, providing a regular income stream for investors.

Advantages and Disadvantages of Focusing on Top Market Cap Companies for Investment

| Advantages | Disadvantages |

|---|---|

| Perceived Stability | Potential for Slower Growth |

| Growth Potential | Valuation Concerns (Overpriced?) |

| Dividend Payments | Susceptibility to Market Corrections |

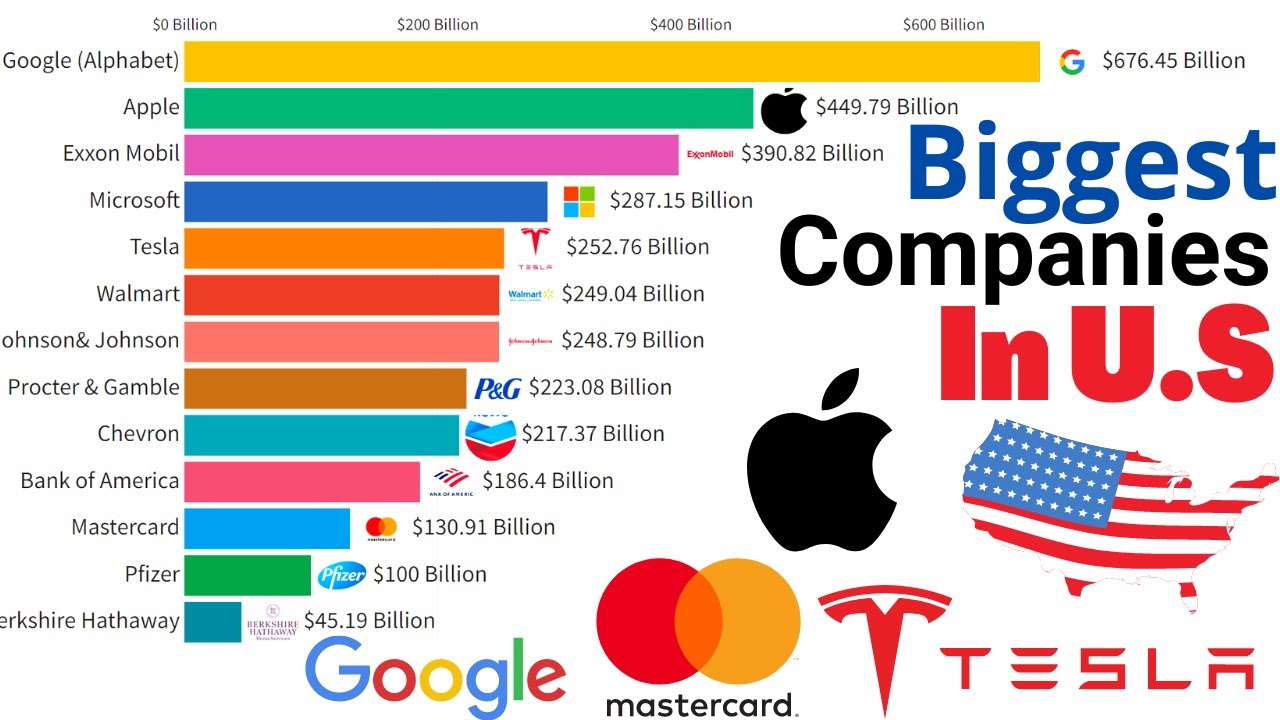

Five real-world examples of top market cap companies (as of late 2023, subject to change) include Apple, Microsoft, Amazon, Alphabet (Google's parent company), and Tesla. These companies span diverse sectors, from technology and e-commerce to automotive and artificial intelligence, demonstrating the range of industries represented at the top of the market cap rankings.

A common challenge for these large companies is maintaining their innovative edge. As companies grow, they can become more bureaucratic and less agile. One solution is to invest heavily in research and development and create internal structures that encourage experimentation and new ideas.

Frequently Asked Questions:

1. What is market capitalization? (Answered above)

2. How often does the list of top companies by market cap change? (Constantly, due to fluctuating share prices)

3. Does a high market cap guarantee a company's future success? (No, it's a snapshot of current valuation, not a predictor of future performance.)

4. Where can I find the current list of top companies by market cap? (Financial news websites, stock market trackers)

5. Is it wise to invest only in top market cap companies? (Diversification is key for a balanced portfolio.)

6. What factors can influence a company's market cap? (Earnings reports, industry trends, global events, investor sentiment)

7. Are there risks associated with investing in large-cap companies? (Yes, all investments carry risk, including market downturns and company-specific issues.)

8. How can I learn more about market capitalization and company valuations? (Books on investing, online courses, financial advisors)

A tip for understanding market cap is to remember it's a relative measure. Comparing a company's current market cap to its historical market cap can reveal trends in investor sentiment and company performance.

In conclusion, the landscape of the most valuable companies by market capitalization is a dynamic and fascinating reflection of the global economy. These corporate giants shape our world in countless ways, influencing not just our investments but also our daily lives. Understanding how market cap is calculated, its significance, and the factors that drive it offers valuable insights for navigating the world of finance and business. By staying informed about these market leaders, their challenges, and their innovations, we can gain a deeper understanding of the forces shaping our economic future. Staying curious about these market movers and shakers is a rewarding way to stay engaged with the ever-evolving world of business and finance. Consider researching a company that piques your interest and learning more about its journey to the top. You might be surprised by what you discover!

Unraveling the enigma of baddies east free on a comprehensive exploration

Jesus calling february 4

Wheel nut torque your uk guide to safe driving