Ditch the Stamps! Your Guide to Sending an eCheck with Bank of America

We live in a world obsessed with instant gratification. Two-day shipping? Not fast enough. Need to pay rent? Forget paper checks! We want it all, and we want it now. Luckily, when it comes to banking, technology is keeping pace (most of the time). Gone are the days of snail mail checks and trips to the bank. Now, we can send money with a tap on our phones, and electronic checks, or eChecks, are leading the charge. So, if you're a Bank of America customer looking to ditch those paper checks for good, buckle up. We're diving deep into the world of eChecks and showing you exactly how to send them.

Imagine this: you’re backpacking through Southeast Asia, trying to book a last-minute jungle trek. The catch? The tour company only accepts payments via bank transfer. Sound familiar? Before you panic (or pull out your dwindling cash reserves), remember the power of the eCheck. It's basically a digital version of a paper check, processed electronically, meaning it can zoom its way across the globe in a flash. Faster payments mean happier tour operators and a better chance of scoring that last spot on the trek.

Now, the history of eChecks isn't as glamorous as, say, the invention of the internet (thank you, Al Gore?), but it's pretty darn important. See, before eChecks hit the scene, businesses and individuals were stuck with paper checks or expensive wire transfers. Not ideal, right? But in the early 2000s, eChecks emerged as a cost-effective and faster alternative. They gained popularity quickly, and today, they're a widely accepted form of payment.

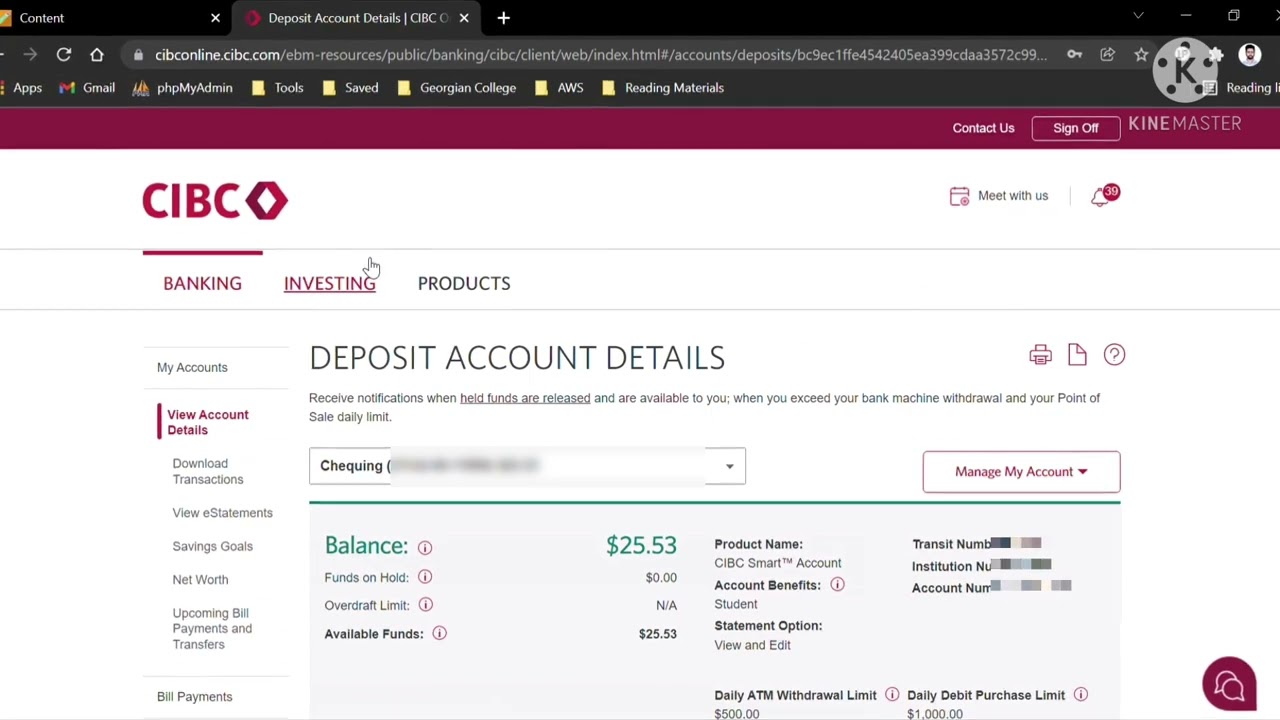

The beauty of eChecks lies in their simplicity. When you send an eCheck with Bank of America, you're essentially authorizing the bank to electronically debit your account and send the funds to the recipient. This eliminates the need for paper, envelopes, and trips to the mailbox (or finding a post office in a foreign country!). It's secure, convenient, and, did I mention, fast?

But the million-dollar question remains: how do you actually send an eCheck with Bank of America? Don't worry, it's easier than navigating the backstreets of Bangkok.

First, log in to your Bank of America online banking account. Next, navigate to the "Bill Pay" or "Transfers" section. Select the option to send money using an eCheck. Enter the recipient's information, including their name, bank account number, and routing number. Specify the amount you want to send, add a memo (optional), and review the details carefully. Finally, hit that glorious "Send" button, and boom – your eCheck is on its way.

While sending an eCheck might seem like second nature to some, others might still be clinging to their checkbooks. But trust me, once you go digital, you won't go back.

Advantages and Disadvantages of Sending eChecks with Bank of America

| Advantages | Disadvantages |

|---|---|

| Convenient and Fast | Potential for Delays or Rejections |

| Cost-Effective | Security Concerns |

| Improved Record Keeping | Limited Acceptance |

So, what are you waiting for? Embrace the digital age and say "adios" to paper checks forever. Your future self (and your wallet) will thank you.

Spice up your screen safely your guide to secure live wallpapers

Decoding dark ash blonde hair color

Unleash your creativity the world of personalized venom lego minifigures