Decoding Your Check: A Guide to Finding Your Account Number

Have you ever stared at a check, feeling a momentary wave of confusion about where to find your account number? It's a common experience, even in our increasingly digital world. Checks remain a relevant form of payment, and understanding their anatomy is essential for managing your finances.

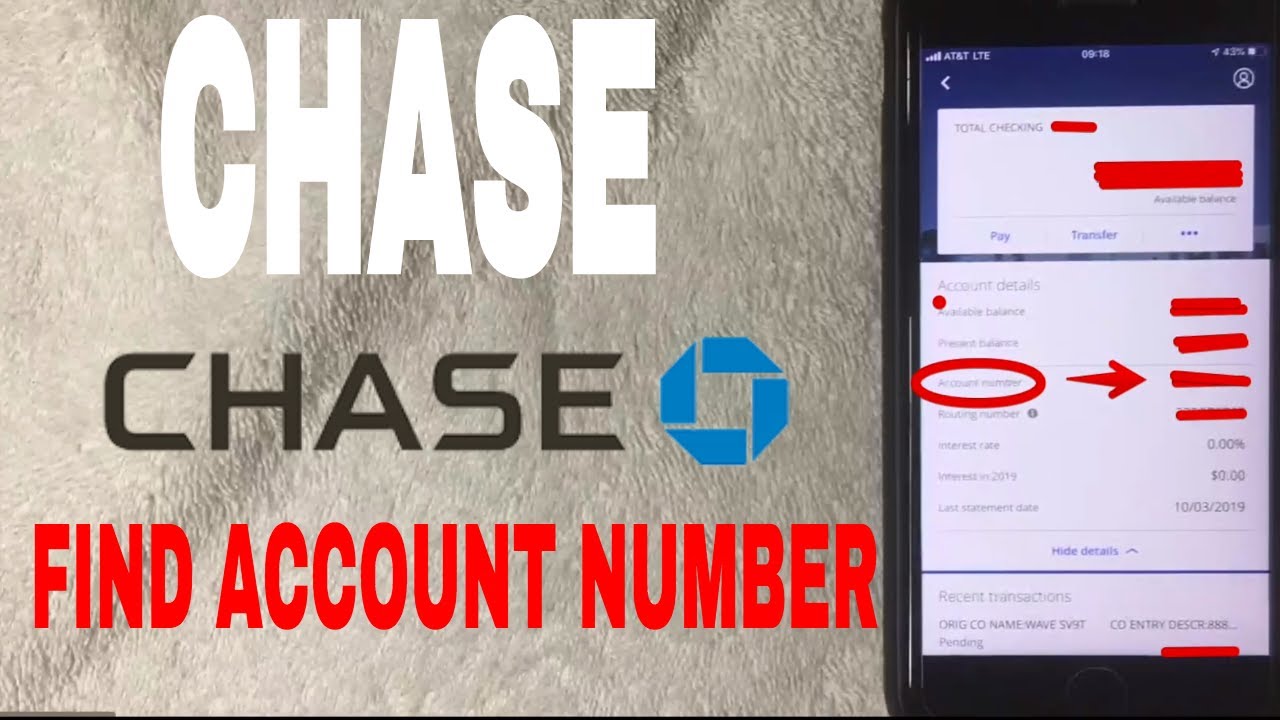

Knowing your checking account number is crucial for various banking tasks, from setting up direct deposit to making online payments. This seemingly small string of numbers acts as a key to your financial resources, allowing you to access and manage your funds. This guide will walk you through the process of locating your account number on a check, ensuring you can navigate your finances with ease.

Checks have a rich history, evolving from handwritten notes promising payment to the standardized forms we use today. The placement of the account number, along with other key details like the routing number and check number, has been carefully designed to facilitate efficient processing and prevent fraud. Understanding this history helps us appreciate the significance of each element on a check.

Locating your account number isn't just about filling out deposit slips; it's about taking control of your finances. It empowers you to manage your money effectively and ensures accurate transactions. Misidentifying your account number can lead to delays, returned checks, and potential fees. Therefore, accurately identifying this vital piece of information is paramount.

This article aims to demystify the process of finding your account number on a check. We'll explore the different types of checks, provide clear visual examples, and answer frequently asked questions to ensure you can confidently manage your financial transactions.

Your account number is typically a string of 8-12 digits located at the bottom of your check. It appears twice: once printed along the bottom edge, and again encoded in magnetic ink character recognition (MICR) format. The MICR line is the series of strange-looking numbers at the very bottom of the check, and your account number is the middle set of numbers on this line, situated between the routing number and the check number.

Knowing how to find your checking account number is essential for various banking transactions. For example, when setting up direct deposit, you'll need to provide your account number to your employer. Similarly, making online bill payments often requires entering your account number to link your checking account to the payment platform.

Here are three key benefits of knowing where to locate your account number:

1. Efficient Transactions: Quickly finding your account number streamlines banking tasks, saving you time and frustration.

2. Accurate Payments: Correctly identifying your account number ensures that your payments are processed accurately and prevents potential errors or delays.

3. Enhanced Security: Being familiar with your check's layout helps you detect any discrepancies or potential signs of fraud.

Step-by-step guide to finding your account number:

1. Turn your check over, face up.

2. Locate the MICR line at the very bottom of the check.

3. Your account number is the middle set of numbers on this line, situated between the routing number on the left and the check number on the right.

Advantages and Disadvantages of Knowing Your Account Number

| Advantages | Disadvantages |

|---|---|

| Empowers financial control | Risk of fraud if account number falls into the wrong hands |

Best Practices:

1. Store your checkbook securely to prevent unauthorized access to your account information.

FAQs:

1. What if my check doesn't have a MICR line? Contact your bank.

Tips and Tricks:

Double-check the account number you enter for any transaction to avoid errors.

In conclusion, understanding where to find your account number on a check is a fundamental skill for managing your finances. This seemingly small detail plays a significant role in ensuring accurate and efficient banking transactions. From setting up direct deposit to making online payments, knowing your account number empowers you to take control of your money. By familiarizing yourself with the layout of your check and following the simple steps outlined in this guide, you can navigate your financial life with confidence and avoid potential pitfalls. Taking the time to understand this crucial piece of information allows for smoother financial management, reduces the risk of errors, and contributes to a more secure financial future. So, the next time you pick up a check, remember the power held within those numbers and use this knowledge to your advantage.

The art of the spruche fur guten morgen finding inspiration in the dawn

Remembering mary lou graves finding and understanding obituaries

Mastering the art of borrowing the essential guide to item loan requests