Decoding Western Union Money Transfer Fees

Planning to send money internationally? You're likely exploring services like Western Union. But before you commit, wouldn't it be great to know exactly how much that transfer will cost? This is where a Western Union money transfer fee estimator comes into play. These handy tools help you decode the sometimes complex world of remittance fees.

Western Union has been a key player in the money transfer game for over 150 years, connecting people across borders. However, navigating their fee structure can sometimes feel like deciphering a secret code. A Western Union fee calculator helps illuminate these costs, allowing you to budget effectively and avoid any surprises.

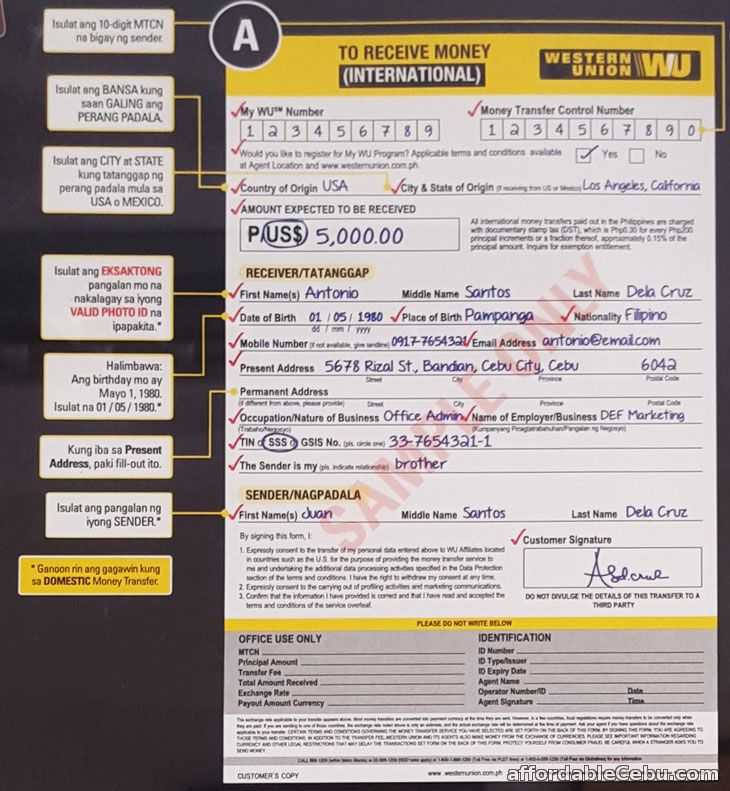

So, how do these calculators work? Essentially, they take into account several factors influencing the final transfer cost. These typically include the destination country, the amount being sent, and the payment method (bank transfer, credit card, or cash). By inputting this information, you get a preview of the associated fees, empowering you to make informed decisions.

Why is understanding Western Union's fee structure so crucial? Transparency is key when dealing with financial transactions. Knowing the cost upfront allows you to compare services, potentially saving you money. A Western Union transfer cost calculator puts the power back in your hands, allowing you to budget accurately.

The rise of online money transfer fee calculators mirrors the growth of digital finance. These tools offer a convenient way to access fee information, eliminating the need for lengthy phone calls or branch visits. In today's fast-paced world, convenience is king, and these calculators provide just that.

Western Union Transfer Cost Breakdown

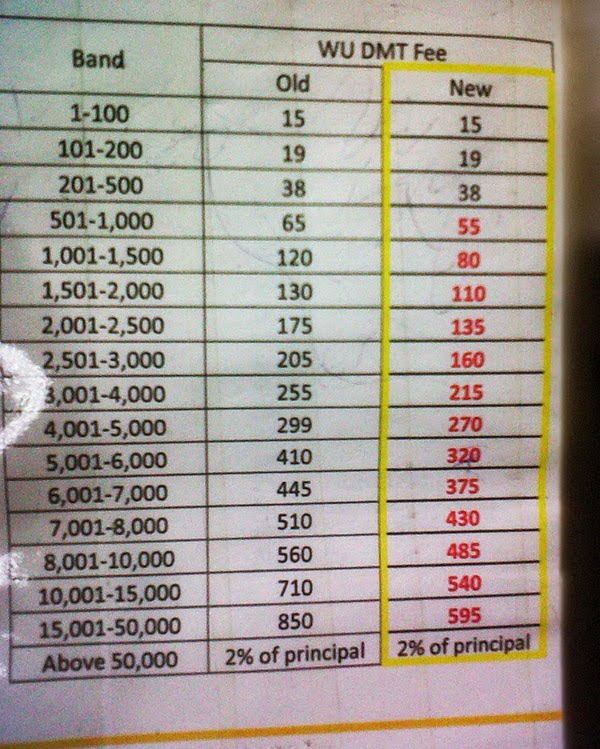

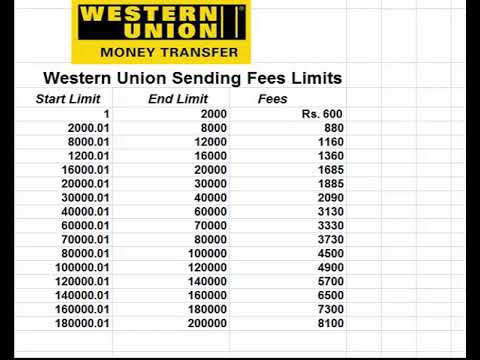

Several factors can impact the fees you'll pay. Destination country regulations, currency exchange rates, and transfer speed all play a role. Understanding these factors helps you make sense of the estimated cost provided by a Western Union money transfer charges calculator.

Benefits of Using a Fee Estimator

1. Budgeting Power: Knowing the cost upfront empowers you to budget effectively.

2. Comparison Shopping: Compare Western Union's fees with other services to find the best deal.

3. Transparency and Control: No more hidden surprises – you're in control of your transfer costs.

Finding a Western Union Money Transfer Calculator

Many online financial comparison websites offer Western Union money transfer fee estimators. Simply search for "Western Union fee calculator" to find a suitable tool.

Advantages and Disadvantages of Using Western Union

| Advantages | Disadvantages |

|---|---|

| Widely available globally | Can be more expensive than other services |

| Fast transfer speeds | Exchange rates may not be the most favorable |

| Multiple payment and payout options | Fees can vary significantly based on location and transfer method |

Best Practices for Sending Money with Western Union

1. Compare Fees: Always use a calculator to compare costs before initiating a transfer.

2. Check Exchange Rates: Be aware of the exchange rate applied to your transfer.

3. Consider Transfer Speed: Faster transfers often incur higher fees.

4. Explore Payment Options: Different payment methods may have different fee structures.

5. Verify Recipient Information: Ensure all recipient details are accurate to avoid delays or errors.

Frequently Asked Questions

1. Where can I find a Western Union money transfer cost calculator? Online comparison sites are a good place to start.

2. What factors affect Western Union fees? Destination country, transfer amount, payment method, and transfer speed.

3. Are Western Union fees fixed? No, they vary depending on several factors.

4. Can I send money online with Western Union? Yes, they offer online transfer services.

5. How long do Western Union transfers take? Transfer times can range from minutes to several days.

6. Is it safe to use Western Union? Yes, they are a reputable company with security measures in place.

7. Can I track my Western Union transfer? Yes, they provide tracking services.

8. What are some alternatives to Western Union? Other money transfer providers include MoneyGram, Ria, and TransferWise.

Tips and Tricks for Saving Money

Consider sending larger amounts to potentially benefit from lower fees per dollar. Compare various payment methods to find the most cost-effective option. Be flexible with transfer speeds; slower transfers are sometimes cheaper.

In conclusion, a Western Union money transfer fees calculator is a powerful tool for anyone sending money internationally. It brings transparency and control to the often confusing world of remittance fees. By understanding the factors influencing transfer costs and utilizing a reliable fee estimator, you can budget effectively, compare services, and ultimately save money. Take advantage of these readily available online tools to ensure you’re getting the best possible deal on your next Western Union transfer. Informed decision-making is key to maximizing your financial resources and ensuring your money reaches its destination safely and efficiently. Don’t hesitate to explore different calculators and compare options before committing to a transfer. Your wallet will thank you.

Dripping shower handle stop that leak now

Navigating chicago your enterprise car rental guide

Upgrade your bathroom with stunning frameless bathtub shower doors