Decoding the JPMorgan Chase Bank Routing Number in Ohio

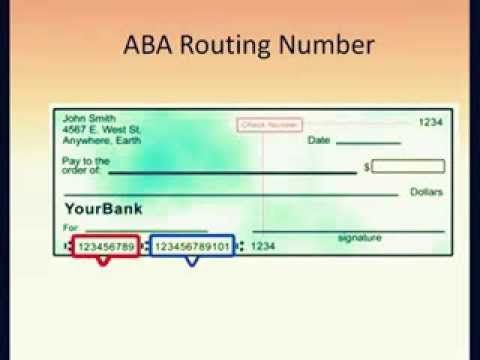

Navigating the world of finance can be complex, especially when it comes to the intricate details of banking. One crucial piece of information that often causes confusion is the routing number. This nine-digit code acts as an address for your bank, directing electronic transactions to the correct financial institution. If you're a JPMorgan Chase customer in Ohio, understanding your specific routing number is paramount for smooth and efficient banking.

This article will delve deep into the world of JPMorgan Chase bank routing numbers in Ohio. We'll uncover the significance of these numbers, explore how to find them, and discuss best practices for ensuring accurate transactions. Whether you're setting up direct deposit, making online payments, or simply managing your finances, having a clear grasp of your routing number is essential.

The routing number system, established by the American Bankers Association, is the backbone of the US financial system, allowing for the seamless transfer of funds between different banks. Each bank has a unique routing number, and JPMorgan Chase is no exception. In Ohio, JPMorgan Chase uses specific routing numbers depending on the region or type of transaction. Using the correct routing number ensures your money reaches the right account, preventing delays and potential complications.

Locating your JPMorgan Chase bank routing number in Ohio can be achieved through several methods. You can find it on your checks, your online banking platform, or by contacting customer support. It's also important to differentiate between the routing number for electronic transfers and the routing number for wire transfers, as these can sometimes differ. Understanding these nuances can save you time and frustration in the long run.

Beyond just knowing where to find your routing number, it's crucial to understand its importance in various financial transactions. From setting up direct deposit to paying bills online, the correct routing number is a vital component. Using an incorrect number can lead to returned payments, delayed deposits, and other financial headaches. This article aims to empower you with the knowledge to avoid these common pitfalls.

JPMorgan Chase, a leading financial institution with a rich history, has evolved through mergers and acquisitions. The bank's presence in Ohio is significant, serving a vast customer base across the state. Understanding this context helps emphasize the importance of using the correct Ohio-specific routing number for your transactions.

A JPMorgan Chase bank routing number identifies the specific branch where your account was opened. It plays a critical role in ACH (Automated Clearing House) transactions, which include direct deposits, bill payments, and electronic transfers. For instance, if you're setting up direct deposit with your employer, you'll need to provide them with the correct JPMorgan Chase routing number for your Ohio account.

One benefit of knowing your routing number is the ability to set up automatic bill payments. This can simplify your finances and ensure you never miss a due date. Another advantage is the convenience of receiving direct deposits, eliminating the need to physically deposit checks. Lastly, knowing your routing number empowers you to initiate electronic transfers, offering a quick and efficient way to move funds between accounts.

Advantages and Disadvantages of knowing your Routing Number

| Advantages | Disadvantages |

|---|---|

| Seamless Transactions | Potential for Fraud if Mishandled |

| Automated Bill Payments | N/A |

| Efficient Direct Deposits | N/A |

Best Practices:

1. Verify your routing number with official sources.

2. Keep your routing number confidential.

3. Double-check the routing number when making transactions.

4. Contact customer support if you have any questions.

5. Regularly review your bank statements.

Frequently Asked Questions:

1. What is a routing number? (A nine-digit code identifying a bank.)

2. How do I find my routing number? (Checkbook, online banking, customer support.)

3. Is the routing number the same for all JPMorgan Chase accounts in Ohio? (No, it can vary.)

4. What happens if I use the wrong routing number? (Transactions may be delayed or returned.)

5. Can I use my routing number for international transfers? (Typically, a different SWIFT code is needed.)

6. Is my routing number confidential? (Yes.)

7. How can I protect my routing number from fraud? (Keep it confidential, avoid sharing it unnecessarily.)

8. Who can I contact if I have questions about my routing number? (JPMorgan Chase customer support.)

Tips and tricks: Always verify the routing number with official JPMorgan Chase resources. Be cautious of phishing scams and never share your routing number via email or unsecured websites.

In conclusion, understanding the nuances of the JPMorgan Chase bank routing number in Ohio is crucial for anyone holding an account. From setting up direct deposits to managing online payments, the correct routing number is the key to seamless and efficient banking. By following the best practices outlined in this article, you can ensure your transactions are processed accurately and avoid potential complications. Taking the time to learn about your routing number empowers you to take control of your finances and navigate the banking system with confidence. Remember to keep your routing number confidential and always verify it with official sources before use. By staying informed and proactive, you can enjoy a smoother, more secure banking experience. Contact JPMorgan Chase customer support for any further assistance or clarification.

Wheel bolt pattern mysteries crack the code of your ride

Navigating the one month resignation notice in malaysia

Unlock your tiktok potential adding a website link