Closing a Bank Account? Your Guide to Bank Account Closure Letters

Need to close a bank account? It might seem simple, but taking the right steps, including writing a formal bank account termination letter, can save you headaches down the road. This comprehensive guide will walk you through the process of crafting an effective request for account closure, ensuring a smooth and hassle-free experience.

Closing a bank account is a common financial task. Whether you're switching banks, consolidating accounts, or simply no longer need a particular account, understanding the proper procedure is crucial. A well-written account closure letter is a key component of this process, providing a clear and official record of your request.

While the exact origins of the bank account closure letter are difficult to pinpoint, they likely evolved alongside the formalization of banking practices. As banking systems became more sophisticated, the need for written documentation for account management, including closures, became essential. This formal request helps protect both the bank and the account holder.

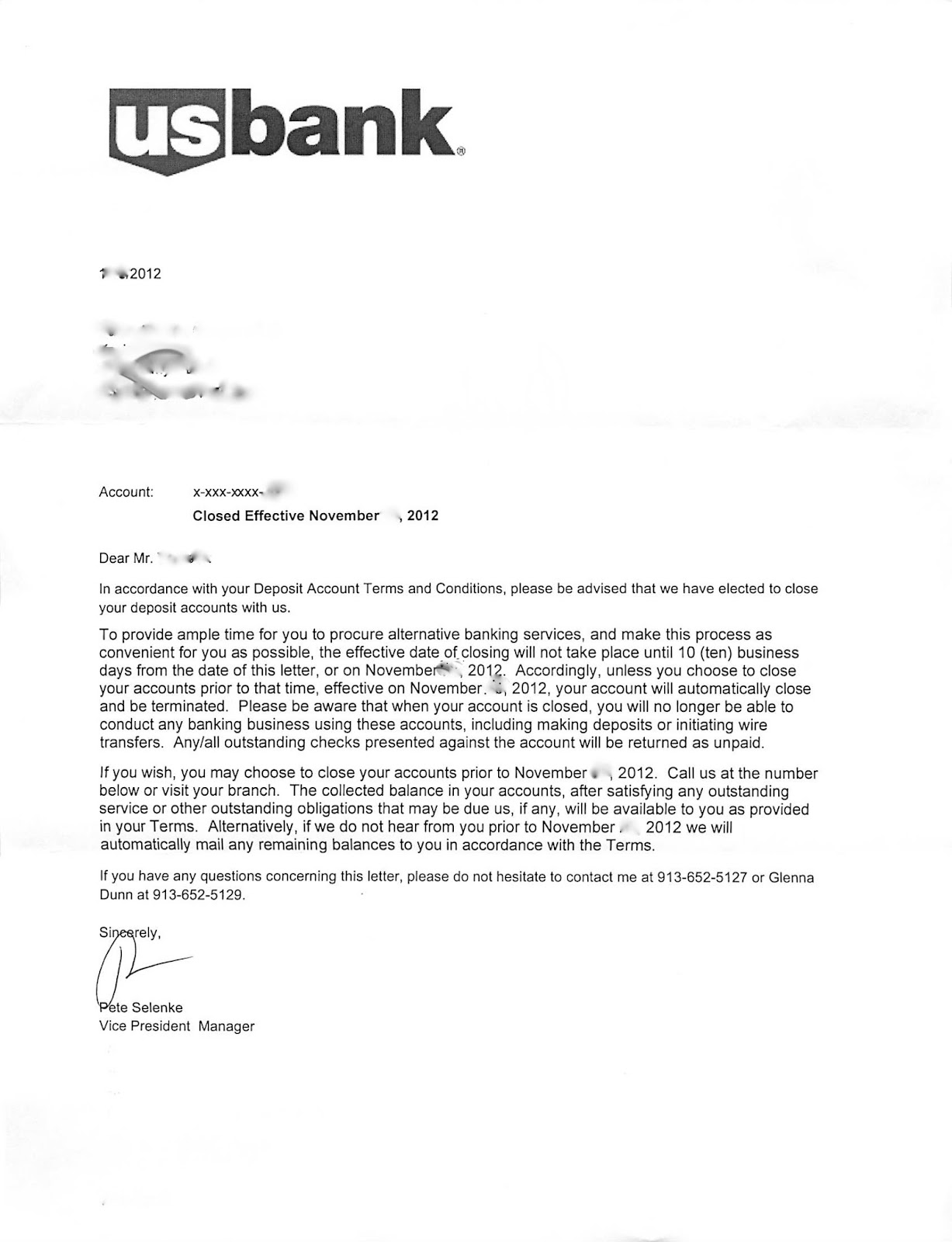

The importance of a bank account closure letter lies in its ability to provide a clear and unambiguous record of your intention to terminate your account. This written documentation serves as proof of your request and protects you from potential issues, such as unauthorized transactions or fees after the supposed closure date. It also helps the bank process your request efficiently and accurately.

Common issues related to closing bank accounts without a proper termination request include delays in processing, potential fees, and difficulty resolving any discrepancies that may arise. A formal letter eliminates ambiguity and ensures a smoother transition.

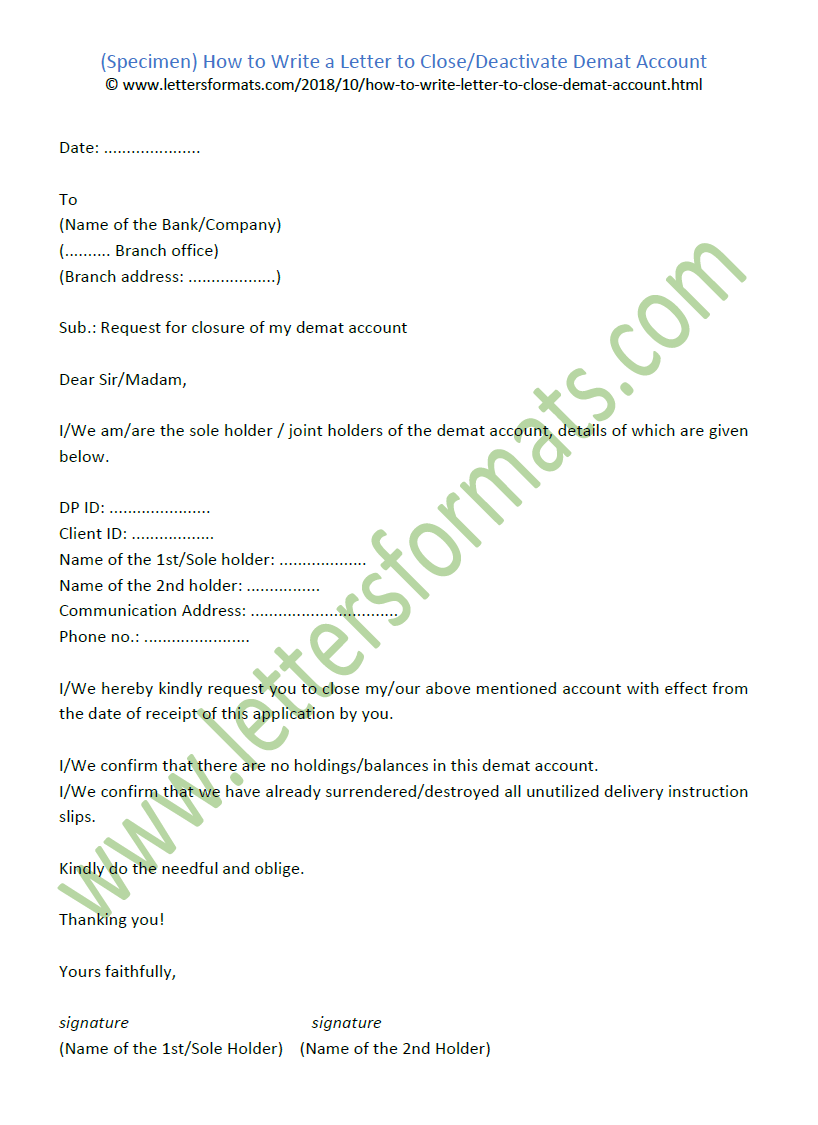

A bank account closure letter is a formal written request submitted to a bank to terminate a specific account. It typically includes details such as the account number, account holder's name, reason for closure, and instructions for disbursing the remaining funds.

For example, if John Doe wants to close his checking account, he would write a letter to his bank stating his intent, providing his account details, and specifying where he wants the remaining balance sent.

One benefit of a closure letter is clarity. It leaves no room for misinterpretation regarding your intention to close the account. Another benefit is documentation. It provides a paper trail that can be helpful in case of disputes. Lastly, it facilitates a smooth process by providing the bank with all the necessary information for closure.

To write a bank account closing letter, first gather your account information. Then, write a formal letter addressed to the bank, stating your request to close the account. Include your account details, reason for closure, and instructions for the remaining balance. Finally, sign and date the letter and deliver it to the bank.

Checklist: Account number, Account holder name, Bank's address, Date, Signature, Instructions for remaining balance, Reason for closure (optional).

Advantages and Disadvantages of Using a Bank Account Closure Letter

| Advantages | Disadvantages |

|---|---|

| Provides a clear record of your request | Requires more effort than simply visiting a branch |

| Protects you from potential issues | May take slightly longer to process |

| Facilitates a smooth closing process |

Best Practice 1: Always keep a copy of your letter for your records.

Best Practice 2: Clearly state your account number and type.

Best Practice 3: Provide clear instructions for the disbursement of funds.

Best Practice 4: Use formal language and avoid slang or jargon.

Best Practice 5: Deliver the letter through a reliable method, preferably in person or via certified mail.

FAQ 1: What happens if I have automatic payments linked to the account? Answer: You should cancel those payments before closing the account.

FAQ 2: Can I close a joint account by myself? Answer: Typically, both account holders need to sign the closure letter.

Tip: Call your bank beforehand to confirm their specific requirements for closing an account.

In conclusion, closing a bank account with a formal bank account termination letter is the best way to ensure a smooth and problem-free process. While it may seem like a small step, a properly written request for account closure offers significant benefits, including clarity, documentation, and protection against potential issues. By following the outlined steps, best practices, and addressing the potential challenges, you can confidently navigate the account closure process and maintain good financial standing. Take the time to craft a clear and concise account closure letter, ensuring that all necessary information is included and delivered to your bank effectively. This simple act of proactive financial management can save you time, money, and unnecessary stress in the long run. Remember to always keep a copy of your letter for your records and contact your bank if you have any questions or concerns. Taking control of your finances includes managing your bank accounts effectively, and closing an account correctly is an essential part of that process.

Ink master season 4 episode 6 recap a battle of styles and strategies

Conquering toenail fungus effective treatments solutions

Your guide to pnc bank branches in michigan