Cara Kira Cukai Pendapatan Bulanan: Mastering Your Malaysian Taxes

Navigating the world of taxes can feel like venturing into a dense jungle, especially in a new country. In Malaysia, understanding "cara kira cukai pendapatan bulanan" – the method of calculating monthly income tax – is crucial for residents and citizens alike.

Whether you're a fresh graduate stepping into the workforce or an experienced professional, getting a handle on your tax obligations is essential for financial peace of mind. It's not just about compliance; it's about ensuring you're not overpaying and taking advantage of the deductions and reliefs available to you.

This comprehensive guide delves into the intricacies of the Malaysian tax system, providing a clear understanding of "cara kira cukai pendapatan bulanan." We'll break down the complexities, demystify the jargon, and empower you to confidently manage your tax obligations.

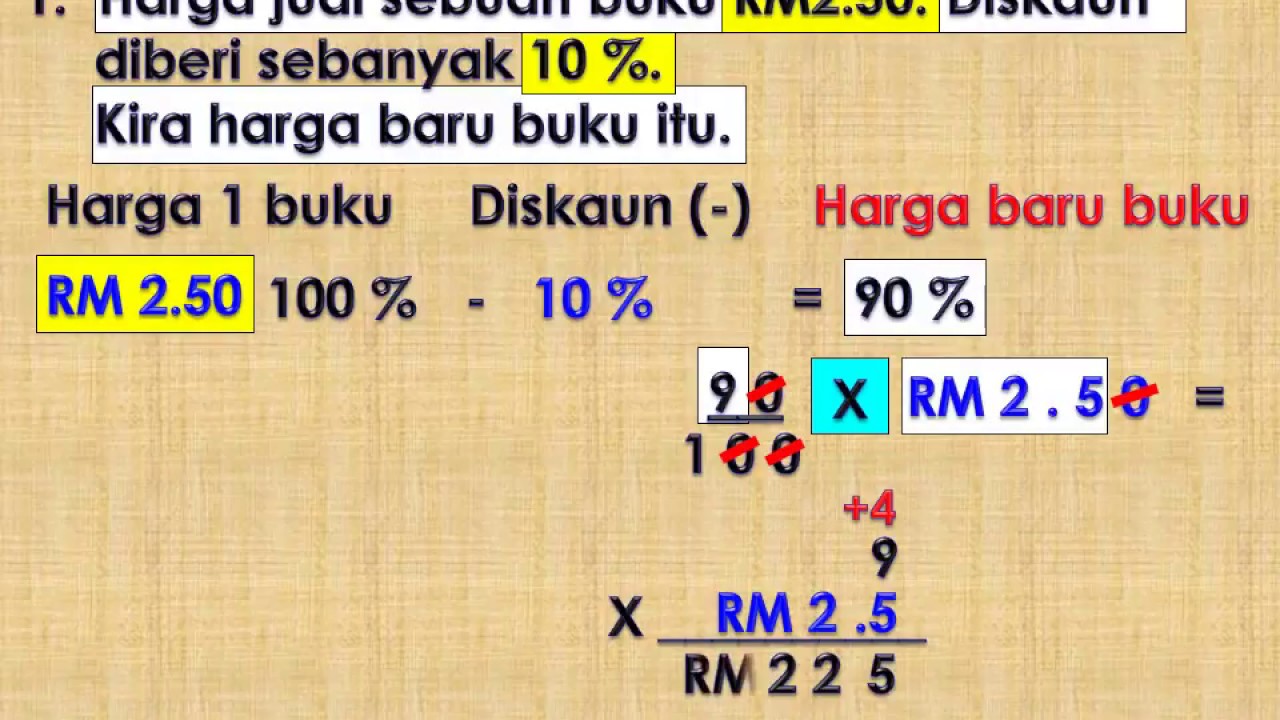

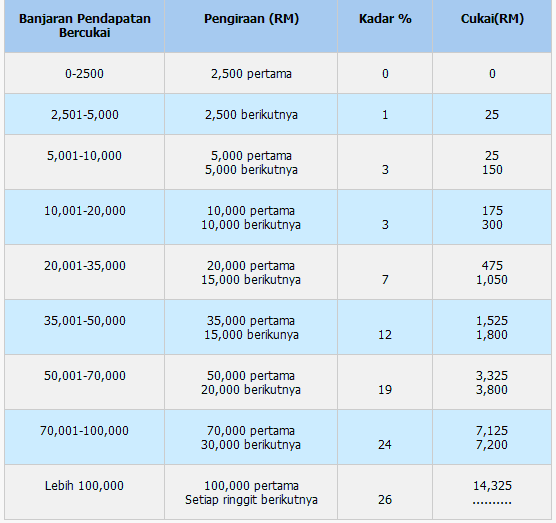

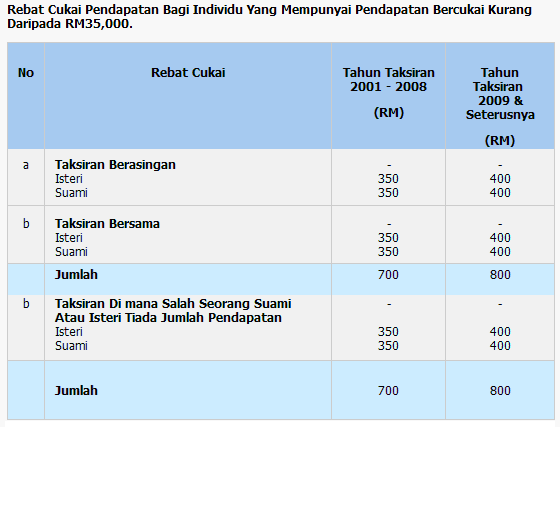

The Malaysian tax system operates on a progressive system, meaning the more you earn, the higher the tax bracket you fall into. "Cara kira cukai pendapatan bulanan" involves understanding your chargeable income, which is your gross income minus allowable deductions and reliefs.

From understanding tax residency to exploring various tax reliefs and deductions, this guide will equip you with the knowledge to optimize your tax position legally. We'll delve into common tax reliefs, such as those for EPF contributions, life insurance premiums, and medical expenses, highlighting how they can significantly impact your tax liability.

Advantages and Disadvantages of Understanding "Cara Kira Cukai Pendapatan Bulanan"

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Managing Your Malaysian Taxes

- Maintain Detailed Records: Keep thorough records of your income, expenses, and tax-related documents for easy reference during tax filing season.

- Understand Tax Deadlines: Mark your calendar with important tax deadlines to avoid late filing penalties.

- Explore Tax Reliefs: Research and familiarize yourself with the various tax reliefs and deductions you qualify for.

- Seek Professional Advice: If in doubt, consult a qualified tax advisor for personalized guidance.

- Leverage Technology: Utilize tax software or apps to simplify your tax calculations and filing process.

Mastering "cara kira cukai pendapatan bulanan" isn't just a box to tick on your to-do list; it's about financial empowerment. By understanding your tax obligations, you gain control over your finances, optimize your tax position, and make informed financial decisions. Remember, staying informed, seeking professional guidance, and utilizing the right tools are key to navigating the Malaysian tax landscape with confidence.

Level up your discord identity the ultimate guide to anime profile pictures

The allure of gacha life boy eyes

The moons pull understanding como afecta la luna a la tierra